When it comes to compensation in the private equity and venture capital industries, bonuses are a key component of one’s pay package, with some professionals earning more than half their compensation through incentive pay. Linked to fund performance, bonuses can often be at times volatile, though in recent years payouts have been relatively healthy. Last year, with robust equity markets and return to more active deal making, private equity firms posted excellent returns for their investors, driving bonuses higher.

One key marker of industry performance, the LPX 50 index which tracks some of the top private equity companies that are publically listed, reflects this strong performance with a near 40 percent return in the past year. When asked to explain the source of these remarkable returns, Sam Armstrong of Barwon Private Equity told Fundweb, “anecdotally it appears to be a range of things: low interest rates and low funding costs, strong earnings margins and more aggressive cost management.”

Armstrong also pointed to flexibility being key for private equity firms, referring to their ability change focus quickly in rapidly evolving markets.

The strong performance posted by the LPX 50 mirrors the sentiment captured by the 2014 Private Equity and Venture Capital Compensation Report. In terms of 2013 fund performance, nearly 19 percent of respondents indicated that they expected their funds to provide returns in excess of 25 percent this past year. A further 47 percent expected returns between 10 and 25 percent, indicating that two thirds of respondents expected double digit returns for 2013. In a time of low fixed income yields, this kind of performance sets up private equity and venture capital well as an alternative asset class, providing diversification for portfolio managers.

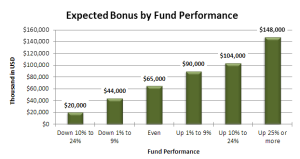

Fortunately for employees of private equity firms, this high level of performance is resulting in lucrative payouts when it comes to bonuses. According to the compensation report, for firms with 25 percent or higher performance in 2013, employees expected a bonus of $148,000 on average. Bonuses for firms reporting gains in the 10-24 percent range averaged $104,000. While the average is likely weighted higher by the remarkable payouts seen by senior management, even the more junior members of these firms likely enjoyed a large bonus this year.

Fortunately for employees of private equity firms, this high level of performance is resulting in lucrative payouts when it comes to bonuses. According to the compensation report, for firms with 25 percent or higher performance in 2013, employees expected a bonus of $148,000 on average. Bonuses for firms reporting gains in the 10-24 percent range averaged $104,000. While the average is likely weighted higher by the remarkable payouts seen by senior management, even the more junior members of these firms likely enjoyed a large bonus this year.

Throughout the full range of performance, from funds that were down on the year to the highest performers, a clear correlation existed between investor returns and bonus payouts. This has become more apparent through the years as investors demand tighter linkages between their own returns and the compensation of their money managers. It also makes sense from a fund perspective, where high bonus payouts can be more easily managed after a year of strong performance and likely net inflows, compared to a year where revenue is scarcer.

As professionals look back on 2013, they’ll remember a year of strong performance and year of high personal compensation. And the next year is looking to be promising as well, with optimism high and a strong start to 2014. With that optimism, private equity and venture capital employees are likely looking forward to another year of strong bonuses as the closer ties between performance and compensation pay off.