Feb 19, 2015 | Performance

After a year of strong performance in the sector, private equity and venture capital professionals posted some remarkable pay gains in 2014. While the S&P 500 posted a fairly strong total return of 14 percent in 2014, the majority of our respondents indicated their funds were likely to beat these equity benchmarks for the year.

Investors looking for diversification along with higher returns compared to other possible alternative asset classes are increasingly looking to private equity as a solution. According to Preqin, 57 percent of private equity firms said they saw increased investor appetite over the last year, while only 12 percent of firms said they saw reduced interest. In an industry where management fees, based on assets under management, drive the bottom line for firms, the increased amount of capital available is one factor in driving up compensation in the industry. Sustained interest in the segment will continue to allow for improved compensation among top performing firms.

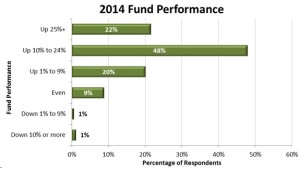

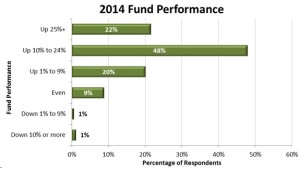

Behind all of this investor interest and new money, of course, is performance. Our survey respondents at private equity and venture capital funds indicated their funds were expected to post stronger returns in 2014 than they did the prior year. At the upper end of the spectrum, 22 percent of respondents indicated their 2014 performance would exceed 25 percent, up 6 percentage points from the prior year. This strong performance is one factor driving compensation higher this year. And in light of increasing volatility in equity markets, the relative stability of private equity returns will be attractive to investors in the coming year.

There is also a correlation between fund performance and bonuses, which comprise a large portion of the total compensation for all finance industry professionals. Our survey results indicated that the strongest performing funds also awarded the largest bonuses to their professionals, as expected. With the highest paid professionals earning sometimes the majority of their compensation through bonuses, fund performance can clearly have a large influence on total compensation payouts.

The coming year looks to be promising for private equity and venture capital firms, and their employees, if performance can be maintained at or near these levels. Increasing equity market volatility will encourage more investors to consider the more stable and long term focused returns consistent with private equity strategies. Firms successful in capturing this investor interest by building their assets under management will likely be the leaders in increasing compensation available to their employees, in order to attract and retain top talent.

Apr 29, 2013 | Performance

While cash compensation is certainly front of mind for most individuals working in the private equity and venture capital industry, training can also be an important piece of overall compensation with significant advantages for both individuals and their firms. With advantages to the firm including increased productivity, increasing firm skill and “bench strength,” and higher retention, its easy to see why funds are looking at options for providing increased training opportunities to their teams. And the team members are appreciating the training as well, with indicators of higher job satisfaction and loyalty.

Many private equity and venture capital firms are smaller in size and struggle justifying the sometimes considerable cash cost of training, especially in a market increasingly moving to a lower fee model. However, these are also firms most well positioned to take advantage of training opportunities. In many of these firms, one or two specialists tends to look after certain firm responsibilities, creating issues when these people choose to depart or become overwhelmed. The firm then needs to desperate seek out a replacement or support, which of course is costly and doesn’t always result in a good fit within the team. Providing training to existing team members to ensure bench strength exists and employees are able to cover for each other, at least in the short term, can provide significant value.

While all employees tend to enjoy the opportunity of expanding their knowledge, young employees who are early in their careers, often stand to gain the most from training and also tend to put greater emphasis on this benefit. In fact, attracting young employees out of school or those with only a few years of industry experience may be easier with a strong reputation as a firm who will help employees build their knowledge. Providing training to young employees will also enable them to see a clear path for advancement within the firm, creating loyalty and also potentially lower recruiting costs for higher positions by promoting from within.

Many firms also worry that training their employees will lead them to seek opportunities elsewhere, losing the value of their investment in training costs and time. This is a valid concern and certainly a number of employees will leave after undergoing training. However, even more employees tend to view the investment by the firm in their skills to be an indicator of loyalty, encouraging them to stay on and seeking potential advancement.

Private equity and venture capital firms certainly do stand to benefit greatly by increasing training programs, especially in areas where it can expand the firm’s internal skill set. As a result, expect to see more teams look to training as a key component of their development plans, while more employees will come to demand training as a core component of their overall compensation.

Feb 18, 2013 | Performance

Across the financial industry, we’ve seen an overall shift to tying bonuses more closely to the firm’s results for its investors. Whether an investment banker is driving corporate profits for shareholders or a private equity fund manager is beating the benchmark for his clients, this trend remains evident. This was clear in our survey of private equity and venture capital professional, where we saw that respondents in low performing firms were no long expecting large bonus checks, while those in exceptional firms were demanding large payouts. It seems that investors will have to live with the reality cutting both ways, perhaps saving on fees during times of weak performance while expecting to pay more for results that exceed industry averages.

Private Equity and Venture Capital Fund Performance Expected to be Stronger in 2012

The expectations for fund performance were considerably improved in our most recent survey in comparison to the previous year. A very solid 80 percent of respondents expected a positive year for their fund, up from only 73 percent in the year prior. On the negative performance side, only 6 percent of respondents expected their firm to post a lost in 2012, which compares favorably to 9 percent in the year prior. Many funds were expecting outstanding performance as well, with over half of respondents indicating that they expected their fund to return over 10 percent for the year. This would mark a substantial jump over 2011 levels and also would indicate outperformance compared to many alternative asset classes.

Expected Bonuses Generally Follow Fund Performance

In our survey, we noticed that expected bonus payouts for the year generally trended in line with fund performance. For example, for funds that were expected to return between 10 and 25 percent in 2012, the average bonus expectation was approximately $175,000. In a fund where returns were expected to be even, the average incentive payment was predicted to be only in the range of $60,000. The expected payout falls even further once a fund begins to lose value, with the average expected payout for a fund losing greater than 10 percent estimated at only $11,000. This dramatic difference between bonus payouts is indicative of the shift in corporate compensation discussed earlier.

As we continue in an environment with generally low overall returns, fees and performance will become increasingly important for individual and institutional investors alike. Accordingly, compensation is going to be increasingly tied to fund performance, especially at the higher levels of the firm where the large bonuses are paid.