Carried interest is one of the defining features of private equity (PE) and venture capital (VC) compensation, representing not only a significant portion of earnings but also a vital motivator for performance. Often called “carry,” it is a cornerstone of wealth creation in the investment management industry.

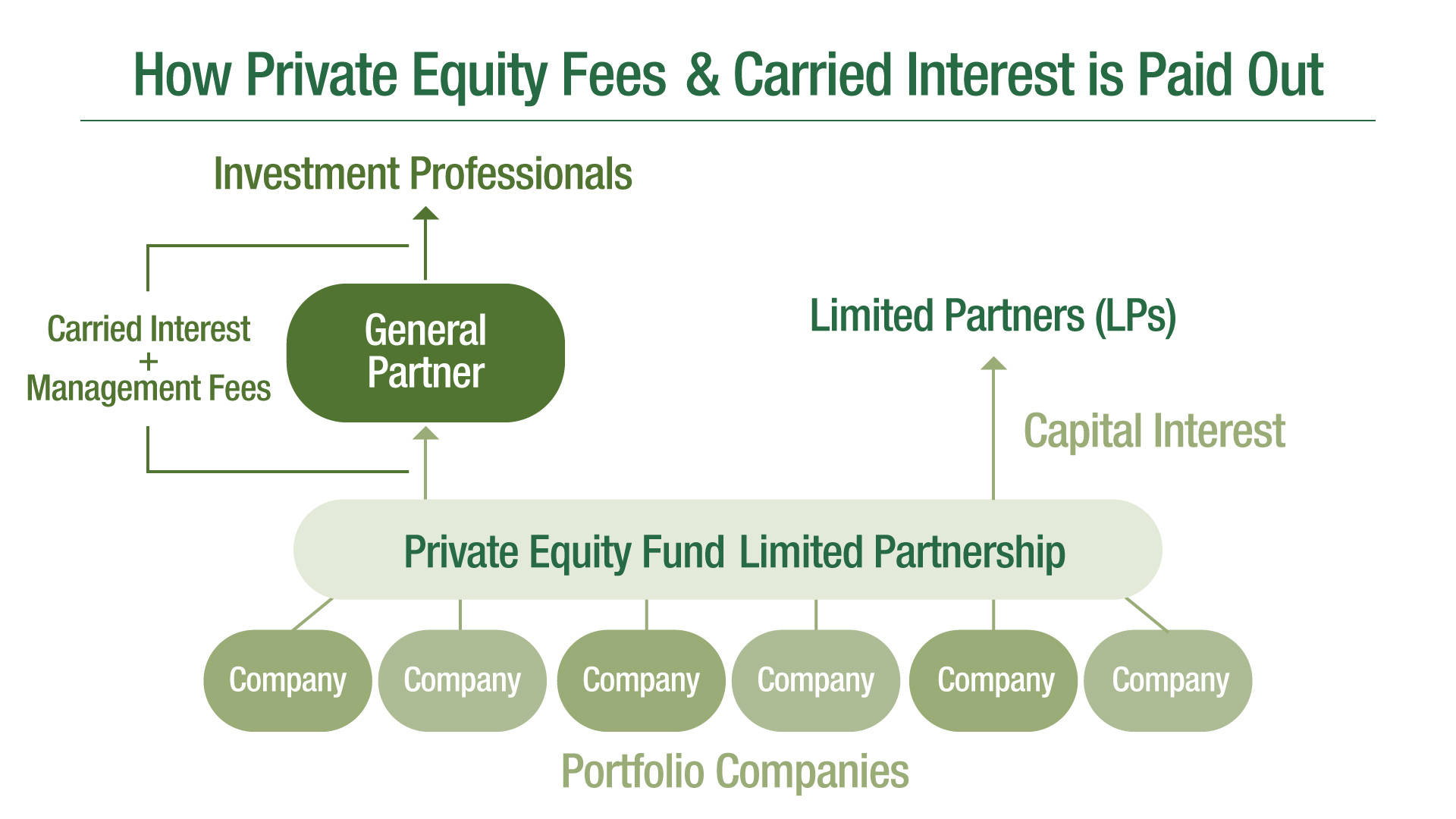

For general partners (GPs) in private equity, this profit-sharing mechanism aligns their financial outcomes with the success of their investments, incentivizing them to deliver strong results for their limited partners (LPs). At the same time, it reflects the high-stakes nature of the industry, where professionals assume significant risks in pursuit of outsized returns.

Understanding this compensation structure is essential for anyone navigating private equity, whether as an aspiring professional seeking to maximize career earnings or as an investor evaluating fund terms. By grasping its intricacies, professionals can unlock a path to long-term wealth, align their performance goals with broader fund success, and make more informed career and financial decisions.

This article explores carried interest in detail, including its definition, mechanics, role in compensation structures, tax implications, and strategies for maximizing its potential.

Table of Contents

What is Carried Interest?

Carried interest, or “carry,” is a share of a fund’s profits allocated to private equity professionals, specifically general partners (GPs), as compensation for managing investments and generating returns. It is a hallmark of private equity and venture capital compensation, distinguishing these industries from other areas of finance.

Carry is a critical alignment tool between the general partners and their investors, known as limited partners (LPs). By linking compensation to fund performance, carried interest incentivizes GPs to deliver superior returns while bearing significant personal and professional risks.

Key Characteristics

- Profit Sharing: Carried interest typically represents 20% of a fund’s profits. While the 20% standard is widespread, variations occur based on fund size, track record, and negotiations. Top-performing funds or GPs with exceptional reputations may command higher percentages while emerging funds might settle for less.

- Performance-Based Compensation: Carry is contingent upon achieving a minimum return for LPs, commonly called the “hurdle rate.” This hurdle rate, often set at 8%, ensures LPs are compensated first, with carry only applying to profits above this threshold. In this way, GPs are rewarded solely for generating value beyond expectations.

- Long-Term Orientation: Unlike salary or bonuses, carried interest accrues over a private equity fund’s lifespan, typically 8–12 years. Furthermore, payouts are tied to the successful realization of investments, such as through the sale or public offering of portfolio companies. This multi-year timeline focuses on long-term, sustainable fund performance rather than short-term gains.

These characteristics show how carried interest drives wealth creation while aligning the interests of fund managers and investors.

How Does It Work?

Carried interest operates within the broader structure of private equity investment cycles, intertwining with how funds are raised, deployed, and ultimately exited. To fully grasp its mechanics, let’s examine the key stages of the private equity process where carry plays a critical role.

1. Fundraising

Private equity firms begin by raising capital from institutional investors such as pension funds, university endowments, sovereign wealth funds, and high-net-worth individuals. These LPs commit capital to the fund under agreed-upon terms, which include the percentage of profits (carried interest) the GP will receive.

For example, in a typical 20/80 profit-sharing model, the GP earns 20% of profits after meeting the hurdle rate, while the remaining 80% goes to the LPs. This arrangement reflects a balance between compensating the GPs for their expertise and ensuring LPs receive the lion’s share of returns.

2. Investing

Once the capital is raised, the GP identifies and invests in promising portfolio companies. These investments often target businesses with the potential for substantial growth or operational improvement. Strategies might include restructuring, scaling, or optimizing operations.

During this phase, GPs actively manage their investments, drawing on industry expertise and strategic insight to enhance company value. The ultimate goal is to position these portfolio companies for profitable exits, which directly impacts the potential for carried interest payouts.

3. Exiting Investments

Exits mark the point at which profits are realized. This can occur through various avenues, including:

- Initial Public Offerings (IPOs): Taking a portfolio company public through a stock market listing.

- Trade Sales: Selling the company to another business or strategic buyer.

- Recapitalizations: Restructuring a company’s capital to extract value, often through dividends or debt refinancing.

Profits from these exits feed directly into the carry calculation, provided the fund has surpassed the hurdle rate.

4. Distributing Profits

Once profits are realized, they are distributed according to the fund’s agreed-upon terms. The order of distribution typically includes:

- Returning the initial capital invested by LPs.

- Paying out the hurdle rate (e.g., an 8% annual return).

- Allocating carried interest to the GP (e.g., 20% of profits above the hurdle rate).

- Distributing the remaining profits to LPs.

If the fund fails to meet its performance benchmarks, GPs do not receive carried interest. This performance-based structure ensures accountability, linking compensation to the fund’s success.

A Real-World Example

Let’s look at a practical example to illustrate how carried interest is calculated:

- A private equity fund raises $100 million from LPs.

- Over the investment period, the fund generates $300 million in total value, with $200 million in profits.

- The fund terms include an 8% hurdle rate and a 20% carry for the GP.

Step 1: Return Capital and Hurdle Rate

- The GP first returns the initial $100 million to the LPs.

- Next, the fund must achieve the 8% annual return before the GP earns carry. Assuming the hurdle rate calculation equals $20 million, this amount is also paid to the LPs first.

Step 2: Calculate Profits Eligible for Carry

- After the hurdle rate, the remaining profits are $180 million ($200 million total profits – $20 million hurdle).

Step 3: Allocate Carried Interest

- The GP earns 20% of the profits above the hurdle, equating to $36 million (20% of $180 million).

The remaining $144 million is distributed to the LPs, ensuring they retain the majority of the fund’s returns.

This example underscores how carried interest rewards performance while prioritizing investor returns.

Private Equity Compensation Structures

Carried interest is often the most lucrative aspect of private equity compensation, distinguishing the industry as one of the most rewarding career paths in finance. While base salary and annual bonuses are foundational, carried interest offers the potential for extraordinary wealth accumulation tied directly to investment performance.

Here’s how carried interest fits into private equity’s broader compensation framework.

1. Core Components of Private Equity Pay

Private equity professionals’ earnings are typically composed of three elements:

- Base Salary: This is the fixed annual pay reflecting the professional’s rank and responsibilities. Salaries for junior professionals, such as analysts and associates, generally start between $100,000 and $150,000, while senior GPs or partners can earn over $1 million annually.

- Bonuses: Bonuses are performance-based payouts tied to the individual’s contributions and the fund’s overall success. These payouts often range from 50% to 100% of base salary for junior professionals and can significantly exceed base pay for senior team members.

- Carried Interest: While base salaries and bonuses offer stability, carried interest represents the wealth-building component. For senior professionals, it often dwarfs other forms of compensation, particularly in high-performing funds.

2. Who Receives Carried Interest?

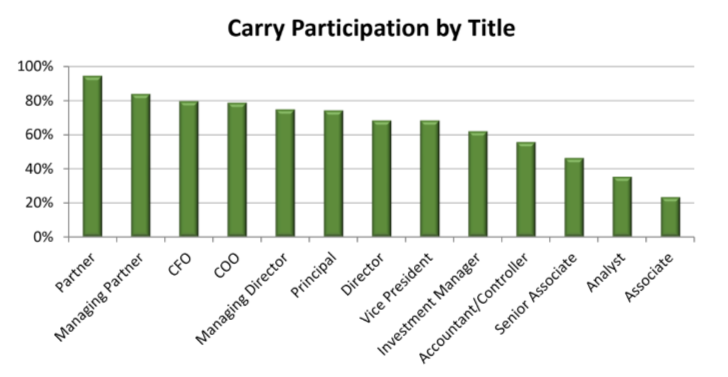

Carried interest is typically reserved for senior members of a private equity team, such as vice presidents, principals, managing directors, and general partners. These professionals play central roles in managing investments, shaping portfolio strategies, and driving successful exits.

As previously noted, participation in the carried interest pool is largely reserved for team members directly involved in investment decisions. For a detailed breakdown of carry participation by job title, refer to our Annual Benchmark Study on Private Equity Compensation, which provides exclusive insights into trends and patterns shaping the industry.

Junior professionals, such as associates and analysts, rarely receive carry directly, though some firms include smaller pools for top-performing juniors to retain talent. For those aspiring to higher roles, gaining access to carry is often a defining career milestone.

3. Vesting and Clawback Provisions

- Vesting Schedules: Carried interest is generally subject to vesting, requiring professionals to remain with the firm for a set number of years (typically 3–5) before receiving their full share. This practice aligns long-term incentives with fund success and encourages retention.

- Clawback Provisions: In cases where initial returns are later offset by losses, LPs may reclaim previously distributed carry. Clawbacks ensure fairness and accountability, particularly in funds that span multiple investment cycles.

Real-World Example

Consider a vice president at a private equity firm with the following compensation:

- Base Salary: $200,000

- Bonus: $100,000

- Carried Interest: A 5% share of carry in a $500 million fund.

If the fund generates $100 million in profits, the VP’s share of carry is calculated as follows:

- 5% of 20% of $100 million = $1 million in carried interest.

This payout highlights how carried interest can significantly enhance total compensation, especially for those with meaningful fund allocations.

Tax Implications

Carried interest is a significant component of private equity compensation and a topic of ongoing political and public scrutiny due to its favorable tax treatment.

1. Current Tax Treatment

In the U.S., carried interest is typically taxed at the long-term capital gains rate of around 20% rather than the ordinary income tax rate of up to 37%. This distinction is based on the idea that carried interest represents a share of investment gains rather than wages. For a detailed explanation of carried interest taxation, visit the Tax Policy Center’s overview.

This favorable tax treatment is often called the “carried interest loophole” by critics, who argue that it allows private equity professionals to pay lower tax rates than most salaried workers, despite the compensation stemming from their labor in managing investments. However, supporters of the current system contend that carried interest should be taxed as investment income, as it reflects the risks and long-term nature of private equity work.

2. Potential Changes

The “carried interest loophole” has been a focal point of tax reform debates for years. Policymakers have proposed taxing this profit-sharing arrangement as ordinary income, arguing that this change would increase tax revenue and ensure equity in the tax system. If enacted, such reforms could significantly reduce the after-tax earnings of private equity professionals, prompting firms to reevaluate compensation structures.

3. Strategies to Navigate Changes

Given the uncertainty surrounding carried interest taxation, private equity professionals should:

- Monitor Policy Developments: Stay informed about potential legislative changes to the carried interest loophole.

- Plan for Flexibility: Work with tax advisors to explore alternative compensation structures or prepare for shifts in tax rates.

- Optimize Tax Efficiency: Utilize deferral strategies and tax-advantaged vehicles to minimize liabilities under potential new rules.

Understanding the implications of the carried interest loophole is crucial for navigating the evolving tax landscape while preserving the value of this critical compensation component.

Maximizing Its Potential

For private equity professionals, maximizing carried interest requires a combination of negotiation skills, career strategies, and long-term wealth planning.

1. Negotiation Tips

- Timing Is Critical: Professionals entering new roles or being promoted should use these transitions to negotiate carry terms. For example, joining a high-performing fund as a principal may offer leverage for securing a larger carry allocation.

- Demonstrate Value: Highlighting contributions such as driving successful exits, improving portfolio company operations, or sourcing profitable deals strengthens the case for higher carry shares.

2. Career Strategies

- Join Established Funds: Larger funds with a track record of success are more likely to generate significant profits, translating to higher carry payouts.

- Specialize in Growth Sectors: Focusing on high-potential industries like technology, healthcare, or renewable energy can increase the likelihood of substantial returns.

3. Long-Term Wealth Management

- Reinvestment: Professionals can reinvest carry payouts into other asset classes, such as equities, real estate, or even launching personal ventures.

- Comprehensive Planning: Establishing a diversified financial plan ensures that carried interest serves as a cornerstone of broader wealth-building strategies.

By aligning professional growth with strategic financial planning, private equity professionals can unlock the full potential of carried interest.

Trends and Insights

The dynamics of carried interest continue to evolve, shaped by industry practices, regulatory developments, and investor demands.

1. Increased Transparency

Institutional investors are pushing for greater transparency around how carry is allocated within private equity firms. Detailed disclosures on carry distribution, fund performance, and individual allocations are becoming more common.

2. Structural Changes

Competition for top talent has led some firms to experiment with innovative carry structures. For instance:

- Tiered Carry Models: Higher percentages of carry are allocated to GPs when funds exceed performance benchmarks.

- Enhanced Carry Shares: Some firms offer carry percentages above the industry standard of 20% to attract experienced professionals.

3. Ongoing Regulatory Debate

The tax treatment of carried interest remains a contentious issue, with potential reforms on the horizon. Regulatory changes could significantly reshape this profit-sharing arrangement, requiring professionals to adapt their financial strategies accordingly.

Key Takeaways for Private Equity Professionals

Carried interest represents a transformative opportunity for private equity professionals to align personal success with fund performance, create long-term wealth, and distinguish themselves in a highly competitive industry.

To maximize its benefits:

- Gain a comprehensive understanding of carry mechanics and tax implications.

- Strategically position yourself within high-performing funds or sectors.

- Incorporate carried interest into a broader financial strategy for sustainable wealth growth.

Whether you’re a junior professional aspiring to earn carry in the future or a seasoned GP managing multi-million-dollar funds, carried interest is a critical component of private equity success.

FAQ Section

1. What is carried interest in private equity?

Carried interest is the share of profits that private equity professionals receive from successful investments, typically after meeting a minimum performance threshold (e.g., an 8% hurdle rate).

2. How is carried interest calculated?

It is usually 20% of the profits after returning the original investment and surpassing the agreed-upon hurdle rate.

3. Why is carried interest taxed at a lower rate?

It is taxed at the long-term capital gains rate (around 20%) because it is considered investment income rather than ordinary income.

4. Do junior professionals receive carried interest?

Not typically. However, some firms include junior professionals in smaller carry pools or grant carry as they advance within the organization.

5. What happens if a fund underperforms?

If a fund doesn’t meet its hurdle rate, the GP receives no carry. Additionally, clawback provisions may require previously distributed carry to be returned.