Private Equity Compensation 2025

Unveiling the 2025 Private Equity & VC Compensation Report: Key Trends, Insights, and Industry Benchmarks

This year’s 2025 Private Equity & Venture Capital Compensation Report marks nearly two decades of providing insights into the dynamic compensation trends shaping the industry. Despite a challenging economic backdrop and global market uncertainties, compensation across private equity and venture capital roles has remained resilient, reflecting the sector’s adaptability and strong competition for top-tier talent.

Total compensation levels continue to climb, with base salaries driving much of the growth. Bonus payouts, however, showed more mixed trends, influenced by fund performance, firm size, and individual contributions. For the first time, 90% of respondents reported earning more than $150,000 annually, setting a new record for industry-wide pay distribution.

While higher pay remains a hallmark of the sector, 62% of professionals reported an increase in total cash compensation this year. Yet, bonus growth varied significantly across firm sizes, with the largest payouts concentrated in firms managing over $1 billion in assets. Bonuses remain predominantly tied to performance, and most firms continue the trend of annual payouts between December and March.

The preference for lean, agile team structures remains a defining characteristic of the industry, with 85% of respondents working in teams of fewer than 25 people. However, this focus on efficiency underscores a persistent weakness: training and professional development programs. Half of respondents rated their firm’s training resources as inadequate, a trend unchanged from prior years.

Key compensation differences persist between private equity and venture capital firms, with hybrid firms offering some of the most competitive packages for senior roles. Venture capital professionals, while typically earning less than their private equity counterparts, saw the largest year-over-year increases in bonus pay.

Hiring patterns reflect cautious optimism, as firms selectively recruit for high-demand positions, particularly in investment roles. At the same time, reductions in headcount across some areas suggest strategic realignments as firms adapt to shifting market conditions.

Other notable findings from this year include:

- Pay Satisfaction: While many senior leaders remain satisfied with their earnings, mid-level professionals, particularly Investment Managers and Associates, expressed growing dissatisfaction.

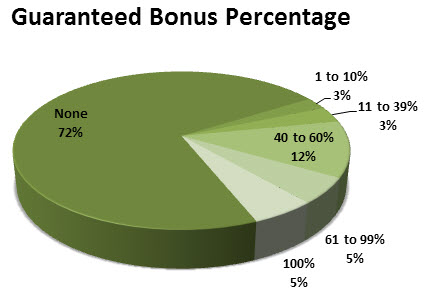

- Bonus Guarantees: Just 29% of respondents reported receiving any form of guaranteed bonus, consistent with prior years.

- Carry Allocations: Executive-level carry participation saw incremental growth, with a 4% rise in allocations exceeding 10% of the pool.

- Fund Performance Trends: Funds achieving returns of 10-24% gained ground, but the percentage of top-performing funds continued to shrink, reflecting broader market volatility.

- Work-Life Balance: Satisfaction with work-life balance remained steady, with 40% reporting above-average or excellent experiences in this area.

The 2025 report offers a comprehensive overview of compensation practices in private equity and venture capital, providing a reliable benchmark for industry professionals. Whether you are negotiating your next role, refining your firm’s pay policies, or planning career moves, this report offers invaluable data and insights.