After a year of strong performance in the sector, private equity and venture capital professionals posted some remarkable pay gains in 2014. While the S&P 500 posted a fairly strong total return of 14 percent in 2014, the majority of our respondents indicated their funds were likely to beat these equity benchmarks for the year.

Investors looking for diversification along with higher returns compared to other possible alternative asset classes are increasingly looking to private equity as a solution. According to Preqin, 57 percent of private equity firms said they saw increased investor appetite over the last year, while only 12 percent of firms said they saw reduced interest. In an industry where management fees, based on assets under management, drive the bottom line for firms, the increased amount of capital available is one factor in driving up compensation in the industry. Sustained interest in the segment will continue to allow for improved compensation among top performing firms.

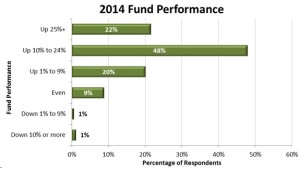

Behind all of this investor interest and new money, of course, is performance. Our survey respondents at private equity and venture capital funds indicated their funds were expected to post stronger returns in 2014 than they did the prior year. At the upper end of the spectrum, 22 percent of respondents indicated their 2014 performance would exceed 25 percent, up 6 percentage points from the prior year. This strong performance is one factor driving compensation higher this year. And in light of increasing volatility in equity markets, the relative stability of private equity returns will be attractive to investors in the coming year.

There is also a correlation between fund performance and bonuses, which comprise a large portion of the total compensation for all finance industry professionals. Our survey results indicated that the strongest performing funds also awarded the largest bonuses to their professionals, as expected. With the highest paid professionals earning sometimes the majority of their compensation through bonuses, fund performance can clearly have a large influence on total compensation payouts.

The coming year looks to be promising for private equity and venture capital firms, and their employees, if performance can be maintained at or near these levels. Increasing equity market volatility will encourage more investors to consider the more stable and long term focused returns consistent with private equity strategies. Firms successful in capturing this investor interest by building their assets under management will likely be the leaders in increasing compensation available to their employees, in order to attract and retain top talent.