One question that many private equity and venture capital professionals are faced with is whether or not to pursue further graduate level education. From a purely financial standpoint, individuals must weigh the costs of MBA programs and the future compensation advantages they may generate. But the decision is not purely financial. Professionals also must way the value of a new network for finding exciting opportunities, and the personal development gained along the way.

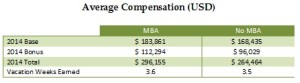

From the financial angle, our 2015 Private Equity and Venture Capital Compensation Report did find an advantage for MBA holders when it came to total compensation. In 2013, respondents with an MBA indicated they earned 19 percent more than their non-MBA peers. However, in the most recent survey, we saw this gap narrow to only 12 percent.

An interesting trend that we’ve noted in the past is that the gap in compensation is driven more by base compensation than it is by bonuses. One possible driver of this differential in base compensation may be that those with MBAs have greater access to the best positions through their well-developed networks. In addition, the credential may open up more senior level positions where base compensation is stronger, depending on the firm and individual’s experience. However this year, we saw that gap close among our survey respondents. In a stronger job market, the MBA may hold less of an advantage than what seemed to exist in leaner times where every possible edge was necessary to land top roles.

On the other hand, however, bonuses have been are largely comparable between those with and without an MBA for some time. Bonuses are driven largely by firm and individual performance. While an MBA may have some additional developed skills through their education, this may not be enough to dramatically tip the scales when it comes to bonuses. MBAs did earn higher bonuses than their non-MBA peers in 2014, both in nominal dollars and as a percentage of total compensation. Relative to total pay, however, the advantage was marginal.

Of course, pursuing an MBA to further one’s career in Private Equity or Venture Capital comes at a high cost. Top MBA programs can run about one-hundred thousand dollars, not including foregone earnings, so future graduates must be confident in their ability to land a role that can pay for this investment upon graduation. In many cases, this isn’t the reality, leaving the benefits of the MBA more intangible to some graduates.