Mar 12, 2015 | MBA

One question that many private equity and venture capital professionals are faced with is whether or not to pursue further graduate level education. From a purely financial standpoint, individuals must weigh the costs of MBA programs and the future compensation advantages they may generate. But the decision is not purely financial. Professionals also must way the value of a new network for finding exciting opportunities, and the personal development gained along the way.

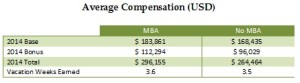

From the financial angle, our 2015 Private Equity and Venture Capital Compensation Report did find an advantage for MBA holders when it came to total compensation. In 2013, respondents with an MBA indicated they earned 19 percent more than their non-MBA peers. However, in the most recent survey, we saw this gap narrow to only 12 percent.

An interesting trend that we’ve noted in the past is that the gap in compensation is driven more by base compensation than it is by bonuses. One possible driver of this differential in base compensation may be that those with MBAs have greater access to the best positions through their well-developed networks. In addition, the credential may open up more senior level positions where base compensation is stronger, depending on the firm and individual’s experience. However this year, we saw that gap close among our survey respondents. In a stronger job market, the MBA may hold less of an advantage than what seemed to exist in leaner times where every possible edge was necessary to land top roles.

On the other hand, however, bonuses have been are largely comparable between those with and without an MBA for some time. Bonuses are driven largely by firm and individual performance. While an MBA may have some additional developed skills through their education, this may not be enough to dramatically tip the scales when it comes to bonuses. MBAs did earn higher bonuses than their non-MBA peers in 2014, both in nominal dollars and as a percentage of total compensation. Relative to total pay, however, the advantage was marginal.

Of course, pursuing an MBA to further one’s career in Private Equity or Venture Capital comes at a high cost. Top MBA programs can run about one-hundred thousand dollars, not including foregone earnings, so future graduates must be confident in their ability to land a role that can pay for this investment upon graduation. In many cases, this isn’t the reality, leaving the benefits of the MBA more intangible to some graduates.

May 13, 2013 | MBA

There are a number of interesting correlations between education in private equity and venture capital compensation. In our report, we primarily looked at the value that an MBA brings to those in the industry, and whether they experience increased earnings compared to their peers. While we found some interesting trends worth consideration, it’s important to note that this may not tell the whole story when it comes to the value of an MBA in the private equity and venture capital industries.

In 2012 we did note that those with an MBA do on average earn more than their lesser educated peers. In fact, when it came to base salaries, those with the advanced degree earned approximately 12 percent more than peers without the degree. Vacation entitlements, generally three and a half weeks, were largely the same regardless of education level, which likely reflects standardization at most firms.

This doesn’t mean, however, that an MBA is a worthwhile investment for all of those looking to undertake the program in order to get a leg up in the private equity industry. There is a substantial cost to pursuing an MBA. The top tier schools that provide the highest boosts in annual earnings aren’t cheap, and a degree can run an individual over $200,000 when all costs are factored in. When discounting the small advantage in higher salary received by MBAs over their career, serious doubts exist about whether the degree pays for itself.

Further, we found that when it came to bonus payouts, education wasn’t such an advantage. In fact, those with MBAs generally earned a smaller bonus, albeit higher total compensation, than their peers. This relates back to the structure of bonuses being driven primarily by tangible results either individually or as a firm. While an MBA can certainly add value, there is no guarantee that will translate into improvements in any given metric a firm uses to tabulate bonus pay. And as a result of these lower bonuses, the total compensation advantage for those with an MBA was only about 4 percent last year.

That said, some of the value of an MBA can’t be measured in dollars. Those with the degree have vast networks established while in these programs, providing them access to more opportunities than those without time spent in the halls of the elite business schools. For some, this could mean the difference between employment and unemployment during tough times. As a result, there are a large number of individuals that still see a great deal of value in the degree, and we certainly wouldn’t disagree.

Mar 18, 2012 | MBA

Professionals looking to advance their private equity careers are often advised to earn an MBA degree. An MBA is often considered essential to business success in the real world, with many professionals feeling the pressure to complete one for better careers success.

However, an MBA is a significant investment in terms of financial cost, time, and effort. With an MBA degree typically taking up to two years of full-time study, it’s critical to first analyze how much it will really help your career and compensation.

Will an MBA increase your total compensation?

Our 2012 Private Equity Compensation Report research found that while MBAs are an advantage, the pay difference is not significant. Particularly for those with over 5 years experience, an MBA certainly does not guarantee better compensation.

In 2011, MBA’s earned 13% more in base salary on average, but received no higher bonuses than those who didn’t have the degree. With the average annual compensation for private equity and VC professionals currently at US$248,000, this equates to a pay difference of roughly $32,240. Compared to the cost of earning a MBA, this may not make the degree as attractive an option for private equity professionals.

While having a MBA can be helpful in the long-term, it can also hurt your chances at new opportunities or pay rises, if your degree isn’t from a top business school. Seth Levine, a top venture capitalist, believes that going to a non top-10 business school will actually hurt your career.

According to Levine, “I know of several firms that simply won’t even consider associate candidates that haven’t attended a very short list of topic schools. In fact, going to a non-top 10 business school could actually hurt your chances vs. not going at all.”

Alternatives to increase your compensation

Considering the two years of lost experience and the cost of the degree, obtaining a MBA may not be the best move for your private equity career. If you’re simply looking for a higher paycheck, an MBA may not be the answer. Instead of turning to an MBA to advance your salary, our research found that compensation was influenced more by fund size, firm type, experience, and job title, among other factors.