Apr 9, 2014 | Bonuses

When it comes to compensation in the private equity and venture capital industries, bonuses are a key component of one’s pay package, with some professionals earning more than half their compensation through incentive pay. Linked to fund performance, bonuses can often be at times volatile, though in recent years payouts have been relatively healthy. Last year, with robust equity markets and return to more active deal making, private equity firms posted excellent returns for their investors, driving bonuses higher.

One key marker of industry performance, the LPX 50 index which tracks some of the top private equity companies that are publically listed, reflects this strong performance with a near 40 percent return in the past year. When asked to explain the source of these remarkable returns, Sam Armstrong of Barwon Private Equity told Fundweb, “anecdotally it appears to be a range of things: low interest rates and low funding costs, strong earnings margins and more aggressive cost management.”

Armstrong also pointed to flexibility being key for private equity firms, referring to their ability change focus quickly in rapidly evolving markets.

The strong performance posted by the LPX 50 mirrors the sentiment captured by the 2014 Private Equity and Venture Capital Compensation Report. In terms of 2013 fund performance, nearly 19 percent of respondents indicated that they expected their funds to provide returns in excess of 25 percent this past year. A further 47 percent expected returns between 10 and 25 percent, indicating that two thirds of respondents expected double digit returns for 2013. In a time of low fixed income yields, this kind of performance sets up private equity and venture capital well as an alternative asset class, providing diversification for portfolio managers.

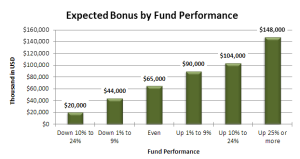

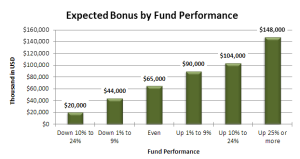

Fortunately for employees of private equity firms, this high level of performance is resulting in lucrative payouts when it comes to bonuses. According to the compensation report, for firms with 25 percent or higher performance in 2013, employees expected a bonus of $148,000 on average. Bonuses for firms reporting gains in the 10-24 percent range averaged $104,000. While the average is likely weighted higher by the remarkable payouts seen by senior management, even the more junior members of these firms likely enjoyed a large bonus this year.

Fortunately for employees of private equity firms, this high level of performance is resulting in lucrative payouts when it comes to bonuses. According to the compensation report, for firms with 25 percent or higher performance in 2013, employees expected a bonus of $148,000 on average. Bonuses for firms reporting gains in the 10-24 percent range averaged $104,000. While the average is likely weighted higher by the remarkable payouts seen by senior management, even the more junior members of these firms likely enjoyed a large bonus this year.

Throughout the full range of performance, from funds that were down on the year to the highest performers, a clear correlation existed between investor returns and bonus payouts. This has become more apparent through the years as investors demand tighter linkages between their own returns and the compensation of their money managers. It also makes sense from a fund perspective, where high bonus payouts can be more easily managed after a year of strong performance and likely net inflows, compared to a year where revenue is scarcer.

As professionals look back on 2013, they’ll remember a year of strong performance and year of high personal compensation. And the next year is looking to be promising as well, with optimism high and a strong start to 2014. With that optimism, private equity and venture capital employees are likely looking forward to another year of strong bonuses as the closer ties between performance and compensation pay off.

Feb 4, 2014 | Bonuses, private equity compensation

The annual bonus is a large part of compensation in the financial industry and this holds true in both private equity and venture capital firms. Depending on a number of factors, bonuses can range from a most welcome “extra paycheck” at the end of the year to a substantial majority of a professional’s total compensation. Our 2013 Private Equity and Venture Capital Compensation Report identified several factors that influence bonuses in the industry, from fund performance to firm size and job titles. Considering all of these elements is critical when attempting to determine whether a bonus is on market or not.

One of the obvious factors that drive bonus levels in the industry is fund performance. Simply put, a firm experiencing greater success is likely to reward its employees most handsomely. This was certainly one of the leading factors in the differences between reported bonus levels. Top performing funds, earning in excess of 25 percent for their investors, rewarded employees with $151 thousand in incentives in 2012. That compares to only $11,000 being awarded to employees in firms that lost over 10 percent of their value. With a clear trend correlated with performance, it’s safe to assume that the majority of a private equity professional’s bonus will be driven by the returns the fund provides to its investors.

Another factor that weighs on the size of one’s bonus is firm size. While performance can also be somewhat correlated with firm size in some cases, it still holds that both the number of employees and the size of the firm or fund weighs heavily in how much bonus compensation an employee will receive. In general, firms that manage more assets tend to offer higher bonuses despite base compensation being largely the same between firms. On average, an employee at a firm managing $1 billion or more in assets earned a bonus of $250 thousand in 2012, while at a firm with under $200 million in assets an employee would be likely to see $100 thousand in incentive pay.

Somewhat surprising, however, is the impact of the number of firm employees on expected bonus size. The highest bonuses were seen among firms with less than 5 employees. This likely reflects the concentration of senior professionals in smaller firms and a higher reliance on results in order to sustain the very existence of the firm.

The rewarding of senior employees through higher bonus payouts was seen across the industry however, not just in small firms. For example, the average bonus of a Director was around between $100 and $130 thousand per year across all firm sizes, while an associate saw between $24 and $66 thousand. The largest bonus payouts were found in those with Partner and Managing Partner titles, with some big firm leaders earning up to $1.5 million in incentive pay in 2012. Across job titles, a clear trend is evident in that more senior employees will find a larger portion of their pay coming from incentives. This trend likely ties in to their greater influence on firm profits.

With this considered, it’s important to keep in mind all of these factors when evaluating incentive compensation. Bonuses can vary heavily based on these factors. However, performance is always the key driving factor in incentive payouts, whether that’s the performance of the fund or an individual’s own contribution. Successful results are always the best way to ensure a higher bonus payment at the end of the year.

Jan 28, 2013 | Bonuses

In both private equity and venture capital compensation, disparity remains a key trend when looking at average salaries by position level. While much of this difference is due to the increased responsibility, time commitment and required experienced level of higher level positions, structural differences in compensation also are a contributing factor. This is not a new trend in private equity nor the financial industry as a whole, as the top few individuals do tend to reap the majority of the rewards of a successful operation.

We also found the range of salaries is greatest in the higher levels of an organization. At the analyst level, the vast majority of individuals are paid within a 10 percent range of the average salary. This climbs at the associate level to a 28 percent range. Ultimately at the Managing Partner level, the range approaches 100 percent, with a great number of positive outliers.

Risk Based Compensation Higher amongst Firm Executives

The division between base compensation and bonuses is very clear between the upper and lower levels of a private equity or venture capital firm. At the analyst level, approximately a quarter of total compensation comes from risk based paid (bonuses). This climbs to nearly half of total compensation at the upper levels, from Managing Partners to Principals. In highly successful firms, those at the upper levels of the organization would see an overwhelming majority of their compensation coming from incentive pay.

Ability to Influence Firm Results Rests at the Top

The existence of more risk based pay for those at the higher levels of an organization should not be surprising. This is certainly not a trend unique to the private equity and venture capital industries, but rather exists across the board. The reality is that top executives generally have more ability to influence the results of the organization, whether through setting sound investment and portfolio management practices or through business development activities.

In the early stages of fund development, these executives generally have sacrificed a great deal of compensation, leaving high paying positions as experienced industry professionals for uncertain outcomes in small startup funds. Accordingly, higher compensation once the firm enjoys success remains an important incentive for those moving to upstart firms.

While it’s true that most analysts and associates don’t enjoy large scale payouts like firm executives, junior members of an firm that do have a substantial impact on firm results are also generally well compensated for their efforts, or even see promotion.

Jan 14, 2013 | Bonuses

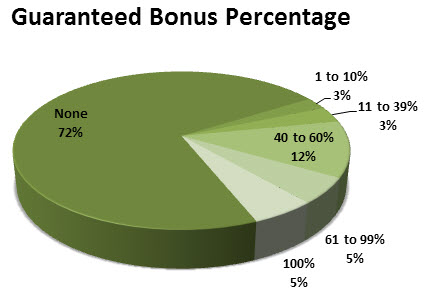

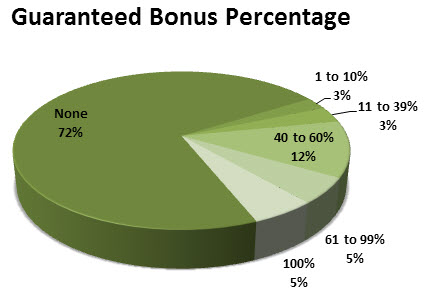

Bonus payouts have always been a substantial component of total compensation in both the private equity and venture capital industries. Bonuses tend to increase as a percentage of total compensation as one’s seniority within a firm increases. High performers in top leadership roles can sometimes expect up to 70 percent of their compensation to come in the form of bonus pay.

In 2012, we found that project bonuses averaged about 36 percent of total compensation, reflecting lower percentages of compensation paid as a bonus in the lower ranks of a firm. Overall, both base pay and bonuses have been increasing, which indicates a healthy private equity and venture capital industry, with plenty of competition for highly talented or experienced individuals.

Firm Performance is Critical in Increasing Bonus Payments

Of course, bonus payments are generally tied to the performance of the firm. Over the past few years, we’ve seen increasingly strong results from a number of private equity funds, which is in turn creating the opportunity for higher bonuses in the sector.

Increasingly, investors are demanding that more compensation is tied to the private equity or venture capital fund’s actual results. This is in contrast to past practices where bonuses were more viewed as an expected component of compensation, rather than a reward for outstanding achievements. In light of the current investment environment where low yields are becoming the new normal, investors are being increasing demanding in terms of fee reductions, unless they are earning returns that can justify higher payouts. In an industry where the greatest expense is people, compensation will need to be tied more closely to performance in order for firms to remain competitive with their fee arrangements.

Composition of Bonus is Important for Job Candidates

When candidates are examining competing job offers, it’s important to take a look at how bonus payouts are calculated, rather than just target levels. Is the bonus linked to reviews of personal performance? Or will you be compensated based on the investing success of the overall firm? If based more on the later, candidates should examine the past performance history of the firm in question, as well as their outlook for the coming year, in order to determine how much of their target bonus (or more) will they likely receive.

Increasing Bonuses Expected to Continue into the Future

Based on the expectation that the economy is likely entering a prolonged period of lower total returns, it seems as though the shift to bonuses as a greater percentage of compensation will continue. Within new fee arrangements, based more upon performance, firms simply cannot afford the risk of high salaries that are not linked directly to the way they are paid themselves by clients. Accordingly, as management fees become more tied to successful investment results, those employed at private equity and venture capital firms will see their pay become more based upon performance incentives.

Fortunately for employees of private equity firms, this high level of performance is resulting in lucrative payouts when it comes to bonuses. According to the compensation report, for firms with 25 percent or higher performance in 2013, employees expected a bonus of $148,000 on average. Bonuses for firms reporting gains in the 10-24 percent range averaged $104,000. While the average is likely weighted higher by the remarkable payouts seen by senior management, even the more junior members of these firms likely enjoyed a large bonus this year.

Fortunately for employees of private equity firms, this high level of performance is resulting in lucrative payouts when it comes to bonuses. According to the compensation report, for firms with 25 percent or higher performance in 2013, employees expected a bonus of $148,000 on average. Bonuses for firms reporting gains in the 10-24 percent range averaged $104,000. While the average is likely weighted higher by the remarkable payouts seen by senior management, even the more junior members of these firms likely enjoyed a large bonus this year.