The finance industry has long been known for working employees, especially junior ones, to the extreme, often demanding upwards of 70 or 80 hours a week. However, recent controversies, including the death of a Bank of America intern after working three consecutive days with no sleep, along with a shift in the broader professional world to more work life balance are beginning to change the industry.

In the 2014 Private Equity and Venture Capital Compensation Report, there was a significant decline in the correlation between the number of hours spent in the office, and the total compensation of the employee. While the lowest pay was found among those putting in less than 40 hours per week, perhaps reflecting part-time employees, the highest pay was not found among those working the most hours, over 90 per week. In fact, there was a considerable drop off in compensation for employees working beyond 70 hours a week.

In the 2014 Private Equity and Venture Capital Compensation Report, there was a significant decline in the correlation between the number of hours spent in the office, and the total compensation of the employee. While the lowest pay was found among those putting in less than 40 hours per week, perhaps reflecting part-time employees, the highest pay was not found among those working the most hours, over 90 per week. In fact, there was a considerable drop off in compensation for employees working beyond 70 hours a week.

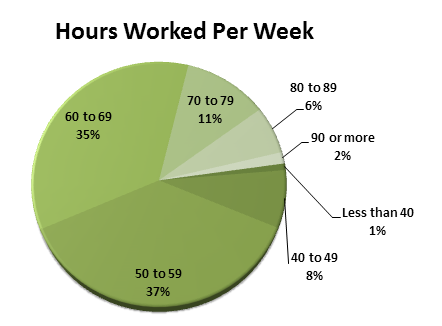

With that considered, working in private equity is almost certainly going to require longer hours than a typical nine to five job. The majority of private equity and venture capital employees worked over 60 hours per week, with a full 54 percent responding they’re putting in such hours. On top of that, an additional 37 percent of respondents indicated they are working between 50 and 59 hours per week. So with 97 percent of employees putting in more than 10 hours of “overtime” per week, those considering a move to the industry should not view recent developments to more balance as a significant decrease in workload.

When it came to vacation time, the report found very little change compared to last year, with the majority of firms offering between 3 and 4 weeks of vacation. A select few offered a generous 5 to 6 weeks, while some firms offered only 2 weeks or even no paid vacation. While 3.4 weeks may have been the average vacation entitlement, employees only took 2.7 weeks in actual leave.

While the industry may be shifting towards more balance, old attitudes remain and work expectations may differ greatly by firm. Some of the old guard in the industry still takes a view that more hours demonstrate greater commitment to the firm. Randall Dillard, managing director and chief investment officer at Liongate Capital Management, recently told a room full of future financial professionals at the 2014 London School of Economics Alternative Investments Conference that 60 hours a week is “not even in the game.”

So even if some of the larger institutions are beginning to take notice of the potential upside of adding more balance, it may be a long time before such views are held industry wide.