Feb 26, 2015 | Culture

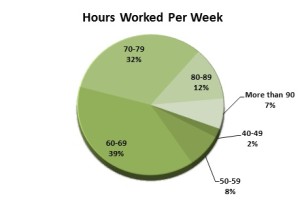

Those in any segment of the financial industry are no stranger to long hours in the office. However, over the past several years, our Private Equity and Venture Capital Compensation Report found that the total hours worked per week by professionals in this segment of the industry had declined, and in some cases, substantially. In 2014, however, we noted a considerable reversal of this trend, raising questions about what changed and why.

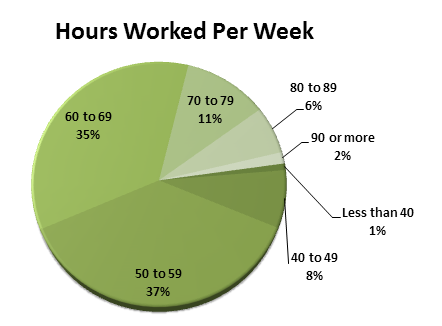

When it came down to the details, we found that 51 percent of respondents to our survey worked at least 70 hours to week. This is a major jump in the number of respondents from this cohort, up from only 20 percent of respondents in the prior year’s survey. However, this data needs to be interpreted carefully, as a slight increase in the number of hours may bump a large percentage of people into another range band in our results. That said, there is a clear increase across the board in the number of hours professionals are spending in the office.

While on the surface some may consider this evidence of a slowing job market, where employees need to work harder to prove their worth, our other data does not support this. Hiring intentions are jump, and fund performance is strong. External data providers, such as Preqin, as indicating investor interest in private equity is improving, not weakening. This leads us to believe that this increase in hours worked may be reflective of positive trends in the industry, with lots of work to do and more deals being closed. The increasing demands on staff will be a positive factor in salary negotiations in coming years, and a tighter labor market with more firms hiring will only contribute to both increased hours in the office and increased salaries.

It’s important to note that those that work the highest hours do not necessarily make the most money per hour worked. In line with previous year’s results, our survey found those working in excess of 90 hours per week made on average $250 per hour, while those at 70 hours per week earned the most, $306 per hour. One important consideration is that hours worked may also reflect one’s position in the organization. Trying to prove oneself as an analyst may require more hours than the work of a Managing Director, even though that too is a demanding role when it comes to office time. These positional differences may account for a portion of the variance we see when it comes to pay per hour worked.

May 20, 2014 | Culture

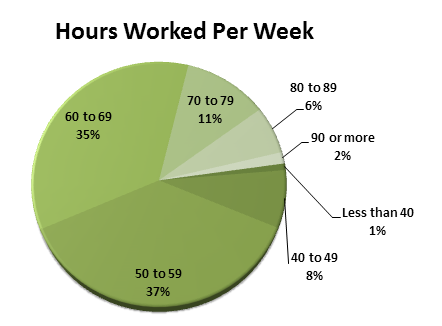

The finance industry has long been known for working employees, especially junior ones, to the extreme, often demanding upwards of 70 or 80 hours a week. However, recent controversies, including the death of a Bank of America intern after working three consecutive days with no sleep, along with a shift in the broader professional world to more work life balance are beginning to change the industry.

In the 2014 Private Equity and Venture Capital Compensation Report, there was a significant decline in the correlation between the number of hours spent in the office, and the total compensation of the employee. While the lowest pay was found among those putting in less than 40 hours per week, perhaps reflecting part-time employees, the highest pay was not found among those working the most hours, over 90 per week. In fact, there was a considerable drop off in compensation for employees working beyond 70 hours a week.

In the 2014 Private Equity and Venture Capital Compensation Report, there was a significant decline in the correlation between the number of hours spent in the office, and the total compensation of the employee. While the lowest pay was found among those putting in less than 40 hours per week, perhaps reflecting part-time employees, the highest pay was not found among those working the most hours, over 90 per week. In fact, there was a considerable drop off in compensation for employees working beyond 70 hours a week.

With that considered, working in private equity is almost certainly going to require longer hours than a typical nine to five job. The majority of private equity and venture capital employees worked over 60 hours per week, with a full 54 percent responding they’re putting in such hours. On top of that, an additional 37 percent of respondents indicated they are working between 50 and 59 hours per week. So with 97 percent of employees putting in more than 10 hours of “overtime” per week, those considering a move to the industry should not view recent developments to more balance as a significant decrease in workload.

When it came to vacation time, the report found very little change compared to last year, with the majority of firms offering between 3 and 4 weeks of vacation. A select few offered a generous 5 to 6 weeks, while some firms offered only 2 weeks or even no paid vacation. While 3.4 weeks may have been the average vacation entitlement, employees only took 2.7 weeks in actual leave.

While the industry may be shifting towards more balance, old attitudes remain and work expectations may differ greatly by firm. Some of the old guard in the industry still takes a view that more hours demonstrate greater commitment to the firm. Randall Dillard, managing director and chief investment officer at Liongate Capital Management, recently told a room full of future financial professionals at the 2014 London School of Economics Alternative Investments Conference that 60 hours a week is “not even in the game.”

So even if some of the larger institutions are beginning to take notice of the potential upside of adding more balance, it may be a long time before such views are held industry wide.

Feb 25, 2014 | Culture

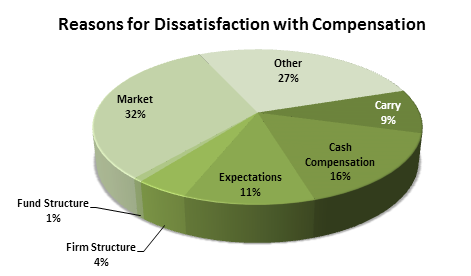

Without a doubt, the private equity and venture capital industries are the source of some of the largest compensation packages in any business worldwide. However, professionals in the industry constantly compare their pay to those in related industries where their skills could be put to use for perhaps higher salaries and bonuses. As a result, monitoring satisfaction with pay for private equity and venture capital professionals is an important activity for managers in the industry concerned with retaining their top talents.

Unfortunately for those managers, the 2014 Private Equity and Venture Capital report found there was a notable decline in pay satisfaction in comparison to last year’s survey. Only 46 percent of employees found themselves satisfied with their pay this year, in comparison to 56 percent of employees in the prior year. This year’s result is still favorable compared to the 41 and 36 percent satisfaction levels noted in the 2012 and 2011 reports respectively, however a shift in the trend will certainly be something that managers will want to keep an eye on in the coming year.

Unfortunately for those managers, the 2014 Private Equity and Venture Capital report found there was a notable decline in pay satisfaction in comparison to last year’s survey. Only 46 percent of employees found themselves satisfied with their pay this year, in comparison to 56 percent of employees in the prior year. This year’s result is still favorable compared to the 41 and 36 percent satisfaction levels noted in the 2012 and 2011 reports respectively, however a shift in the trend will certainly be something that managers will want to keep an eye on in the coming year.

Taking a holistic view on employee satisfaction in the workplace may be one step towards increasing pay satisfaction – the solution isn’t always just increased compensation, but perhaps a more enjoyable workplace where employees don’t just look to cash for satisfaction. This might sound like an attitude more prevalent in a west coast tech start-up, but even Wall Street is starting to take notice, finding that spending a little on Wellness can curb compensation demands.

According to a recent CNN Money report even firms like Goldman Sachs are exploring new ways to motivate employees, whether it be a tai chi club or meditation sessions. While this may be primarily aimed at recruiting and attracting young employees that may be more interested in lifestyle than dollars, the trickle down impacts on the broader employee base can be tangible in lower turnover and less burnout. While there isn’t a great deal of disclosure from private equity firms on innovative wellness initiatives, staying competitive in the overall financial job market will be important going forward.

In many cases, these benefits aren’t about having employees spend less time at the office to find balance, but rather bring many of the employees interests to them in a more convenient package so they can explore their interests in conjunction with the long hours that are often expected in finance jobs. Whether private equity managers explore such initiatives in order to reign in declining pay satisfaction remains to be seen, but these options certainly should be considered as a potential low cost way to build employee enjoyment of their workplace.

May 27, 2013 | Culture

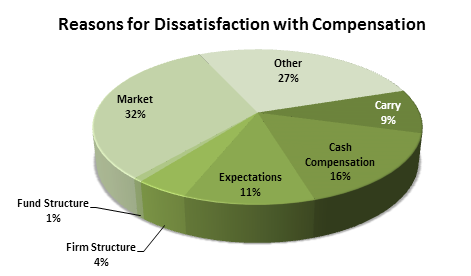

One of the most important factors in retaining top talent in the financial industry is employee satisfaction with their compensation arrangements. Despite this being such a critical leading indicator of potential turnover issues, many firms in the industry do not actively survey their employees on how happy they are with their pay. This can be a critical mistake for firms, especially as the demand for top talent increases as the private equity and venture capital industries grow.

Perhaps not surprisingly, we’ve found that overall pay satisfaction is highly correlated with overall job market conditions within the industry. During times of struggle and declining employment, pay satisfaction tends to increase. However, once the economy heats up and jobs become more numerous, it seems as though employees grow increasingly interested in how much their peers are earning across the street.

2013 Survey Showed an Upward Trend in Satisfaction

That said, despite increased hiring intentions and a relatively robust industry, we’ve seen a markedly upward trend in satisfaction with compensation. According to our 2013 survey, 56 percent of respondents reported they were happy with their pay packages, which is up from 41 percent and 36 percent in the last two years respectively. As the over trends in hiring intentions and employment seem positive, we suspect that the considerable growth in average industry compensation this year is likely a driving factor behind the satisfaction numbers we’ve recorded. However, if our historical understanding of compensation satisfaction holds however, we would expect to see this number begin to decline as hiring intentions begin to shift into real competition for top industry talent.

It is also important to note that satisfaction with pay can fluctuate wildly throughout the year, perhaps with employees feeling underpaid at peak workload periods and adequately compensated during less intense periods. Even a bad day in the office can impact whether someone perceives themselves as being fairly paid.

Overall, the private equity and venture capital industries do reward the hard work of their employees with exceptional compensation. In a broader United States or global employment context, the industry is amongst the most highly compensated in the world. However, that doesn’t mean that some individuals can feel slighted, with much of the dissatisfaction present in the industry is simply competitive tensions and employees wondering if they could make more at another firm. Managing this dissatisfaction is critical to firms that are looking to retain their top talent as competition in the industry heats up.

Apr 15, 2013 | Culture

In light of a more optimistic economic outlook, private equity and venture capital firms are increasingly looking at hiring to fill their ranks. As the job market becomes increasingly competitive, these firms have to become more creative in order to ensure they attract the most talented individuals. While a large compensation package and the prestige of working for top firms will appeal to many job seekers, firms are looking to expand their offerings beyond the traditional lures and are now addressing work life balance in order to attract and retain top talent.

One trend we’ve seen over the past couple of decades is the increasing importance that individuals put on work life balance. In the past, many workers focused solely on earnings potential, but younger generations are not so quick to trade their time for higher pay. In order to address this shift in preferences, firms are looking at ways to offer more flexible schedules and work arrangements, reduce time spent in the office while considering providing more vacation time.

These types of changes reflect a focus on attracting and retaining young workers, individuals that may have obligations raising a young family or taking care of aging relatives. Firms that chose to be more flexible in dealing with employees are at a marked advantage in attracting and retaining those from this high prized demographic group.

While we are seeing improvements, the financial industry has been a slow adopter of work life balance measures in comparison to the overall corporate world in the United States. Some of this is due to simple realities of the business; rigid trading hours still exist and for many positions, people need to be on the desk for a certain amount of time per day. For non-trading positions, however, much of the lack of progress in shifting to a more balanced employment model is cultural. In most firms, working long hours is a badge of honor and more senior employees and managers view time at the desk as a critical measure for advancement.

While this culture of long hours may still exist at most firms, the reality is that in an environment where fee revenue is harder and harder to come by, firms must look at work life balance as a part of an overall compensation package in order to reduce or limit cash costs. As a result, and following an overall trend amongst U.S. companies, we can expect greater focus on this core benefit in the coming years.

Mar 25, 2013 | Culture

When it comes to reasons why individuals choose to work in the financial industry, job security is often pretty low on the list. Compared to jobs in the corporate world or in government, there simply isn’t as much certainty surrounding whether or not an employee will be staying beyond the next paycheck. Performance, both of the individual and the firm, weigh heavily on future employment prospects. That said, feelings around job security are an important measure of the health of the private equity and venture capital industries.

In our 2013 Private Equity and Venture Capital Compensation report, we took a hard look at how employees felt about their job security, and the reasons behind why they felt secure in their roles, or were anxious about their future. Overall, we saw an increase in positive feelings around job security, with 55 percent of respondents this year suggesting that they were not concerned about being let go in the near future. This compares quite strong to last year when less than half of respondents were unconcerned about their continued employment prospects at their firm. This considerable jump in positive outlooks amongst private equity and venture capital employees reflects well on the health of the industry, and increased competition to attract and retain top talent.

On the other hand, 40 percent of respondents were somewhat concerned about their employment outlook for 2013. In addition, 5 percent were “very concerned,” reflecting considerable doubt about the ongoing engagement with their current firm. Amongst those that were concerned about their job security over the next year, there was quite a divide in terms of the reasons behind those fears. Perhaps surprisingly, only 10 percent of respondents were actually concerned that their own performance could lead to their imminent dismissal. On the other hand, a full 74 percent were more concerned about macro factors facing their firm or the entire industry. 45 percent of respondents indicated that their firm’s fundraising ability was the main source of their worry, while 29 percent pointed to overall market conditions as the leading reason they would lose sleep over their job prospects.

On the other hand, those not overly concerned about their job security reported their own performance as the most likely cause of their downfall in 2013, if it were to occur. Changes to firm structure and market conditions were other leading reasons why the lesser concerned respondents felt could influence them to be increasingly concerned as the year rolls on.

Overall, this segment of our compensation report reflects an industry that is getting stronger as it moves forward from years of significant struggles. Increasing job security is just one aspect that reflects a tighter labor market as firms scramble to obtain top talent. As long as economic fundamentals remain steady in 2013, we expect to find employees becoming increasingly comfortable with their job security as we move through this year.

In the 2014 Private Equity and Venture Capital Compensation Report, there was a significant decline in the correlation between the number of hours spent in the office, and the total compensation of the employee. While the lowest pay was found among those putting in less than 40 hours per week, perhaps reflecting part-time employees, the highest pay was not found among those working the most hours, over 90 per week. In fact, there was a considerable drop off in compensation for employees working beyond 70 hours a week.

In the 2014 Private Equity and Venture Capital Compensation Report, there was a significant decline in the correlation between the number of hours spent in the office, and the total compensation of the employee. While the lowest pay was found among those putting in less than 40 hours per week, perhaps reflecting part-time employees, the highest pay was not found among those working the most hours, over 90 per week. In fact, there was a considerable drop off in compensation for employees working beyond 70 hours a week. Unfortunately for those managers, the 2014 Private Equity and Venture Capital report found there was a notable decline in pay satisfaction in comparison to last year’s survey. Only 46 percent of employees found themselves satisfied with their pay this year, in comparison to 56 percent of employees in the prior year. This year’s result is still favorable compared to the 41 and 36 percent satisfaction levels noted in the 2012 and 2011 reports respectively, however a shift in the trend will certainly be something that managers will want to keep an eye on in the coming year.

Unfortunately for those managers, the 2014 Private Equity and Venture Capital report found there was a notable decline in pay satisfaction in comparison to last year’s survey. Only 46 percent of employees found themselves satisfied with their pay this year, in comparison to 56 percent of employees in the prior year. This year’s result is still favorable compared to the 41 and 36 percent satisfaction levels noted in the 2012 and 2011 reports respectively, however a shift in the trend will certainly be something that managers will want to keep an eye on in the coming year.