One of the key determining factors in private equity compensation is the size of the fund the professional is working for. Far from a new trend, we have seen this reinforced in numerous surveys dating back several years. However, the differences in compensation practices between funds of varying sizes are more complex than they appear on the surface, and the underlying complexities may be important to those negotiating compensation in the industry.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

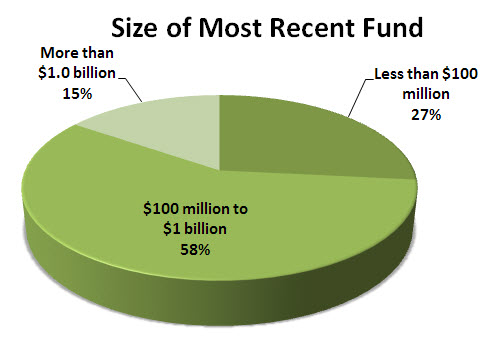

However, one complexity is the difference between the size of the firm a professional works for, and the size of the most recent fund offering that firm has launched. We noted less of a differential between firm size than between most recent fund size, which could be a valuable piece of information for job seekers and recruiters alike. So while the gap between large firms and small firms was about $250 thousand in 2012, the gap between those working for a firm that recent launched a large fund and a small fund was only $200 thousand. This 20 percent differential between fund size and firm size may be key to negotiating higher salary when approaching firms that have launched large funds relative to their size.

Of course, compensation depends heavily on title and here we saw discrepancy between fund sizes as well. As a firm grows, not all positions within the firm seem to benefit from the overall higher trend in total compensation. Those at the higher levels of a firm seem to benefit most from the overall growth in compensation. Principals saw the highest differential, well over 100 percent, in total compensation between small firms and large firms. This is likely due to higher incentive pay amongst senior leaders due to the successful growth of the firm. On the other hand, analysts saw very little difference in compensation between small and large firms, earning only about 25 percent more at large funds.

As we can see, while on the surface it seems simple to suggest that those working for large firms earn more than their small shop counterparts, complexities certainly make the comparison more difficult. Differences in recently launched fund sizes and in position within the organization cloud the overall picture. In order to accurately negotiate compensation, such details need to be factored in by human resources professionals and job seekers alike.