Mar 5, 2015 | Firms

Many professionals in the private equity and venture capital industry wonder whether a potential move to a larger or smaller firm may result in higher compensation. According to the latest results from our 2015 Private Equity and Venture Capital Compensation Report, the overall difference in compensation in 2014 between firm sizes is marginal at best. However, this has not always been the case, and different compensation levels between firm sizes have been noted in previous reports.

Looking at our 2014 data, those working at firms with between 50 to 99 employees tended to earn the highest total compensation. However, these same professionals did not earn the highest salaries, which were reserved for those at firms with 10 to 24 employees. As firm size increased, we saw notable bonus compensation increases offset somewhat by a decline in base compensation. The one exception to this trend was compensation at the largest firms, with over 100 employees. In this example, we found that total compensation was lower than mid-size peers in both bonuses and base pay.

In the past, we noted a stronger U-shape to the profile of total compensation by firm size. Those working at the smallest and largest firms tended to earn the highest compensation, while those at mid-size firms earned the least. This was partially explained by the reality that those at the smallest firms often have to wear many hats and carry a variety of responsibilities, while those at the largest firms benefited from the most stable client revenue streams, allowing their firms to offer higher total compensation.

The robust job market, which we have seen continue to strengthen in our survey results, is a key contributing factor to the flattening of the compensation profile by firm size. When high performing employees have the ability to jump ship to other firms, it forces all players to be more competitive in their total compensation offerings in order to retain their top talent.

Another factor in increasing pay equity across different firm sizes may be the additional transparency when it comes to compensation in the industry. Reports such as ours, and other data sources, allow professionals to better negotiate their pay within industry norms. On the flip side, companies are also better informed in offering pay packages within the ranges.

As long as we continue to experience a robust market, this trend is likely to continue in 2015. With both professionals and firms having better access to compensation data, and job opportunities aplenty, parity among firm sizes in compensation may be a trend that is here to stay, at least for the medium term.

Jan 6, 2014 | Firms

One of the key determining factors in private equity compensation is the size of the fund the professional is working for. Far from a new trend, we have seen this reinforced in numerous surveys dating back several years. However, the differences in compensation practices between funds of varying sizes are more complex than they appear on the surface, and the underlying complexities may be important to those negotiating compensation in the industry.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

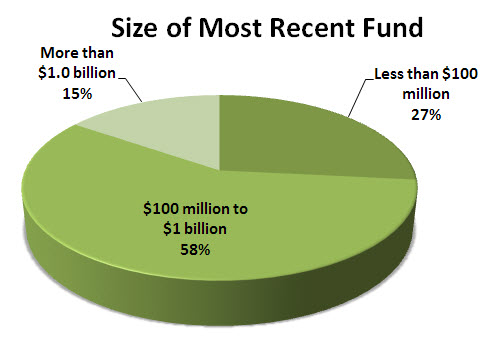

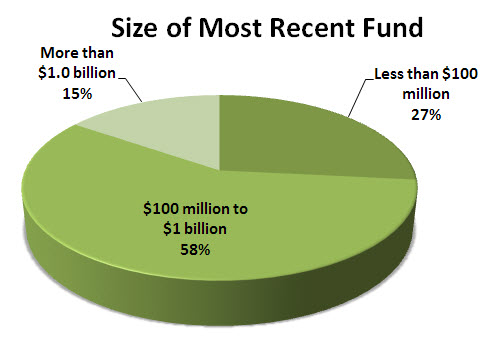

However, one complexity is the difference between the size of the firm a professional works for, and the size of the most recent fund offering that firm has launched. We noted less of a differential between firm size than between most recent fund size, which could be a valuable piece of information for job seekers and recruiters alike. So while the gap between large firms and small firms was about $250 thousand in 2012, the gap between those working for a firm that recent launched a large fund and a small fund was only $200 thousand. This 20 percent differential between fund size and firm size may be key to negotiating higher salary when approaching firms that have launched large funds relative to their size.

Of course, compensation depends heavily on title and here we saw discrepancy between fund sizes as well. As a firm grows, not all positions within the firm seem to benefit from the overall higher trend in total compensation. Those at the higher levels of a firm seem to benefit most from the overall growth in compensation. Principals saw the highest differential, well over 100 percent, in total compensation between small firms and large firms. This is likely due to higher incentive pay amongst senior leaders due to the successful growth of the firm. On the other hand, analysts saw very little difference in compensation between small and large firms, earning only about 25 percent more at large funds.

As we can see, while on the surface it seems simple to suggest that those working for large firms earn more than their small shop counterparts, complexities certainly make the comparison more difficult. Differences in recently launched fund sizes and in position within the organization cloud the overall picture. In order to accurately negotiate compensation, such details need to be factored in by human resources professionals and job seekers alike.

Feb 25, 2013 | Firms

When it comes to private equity and venture capital careers, the size of the company you work for is a key variable in determining how much you’re likely to be paid. According to the findings of our 2013 Private Equity and VC Compensation Report, those working at large firms, defined as those with greater than $1 billion in assets under management, expected to see 81 percent more compensation on average than their small firm peers. While this number may seem shocking on the surface, this is a composite of all respondents. When we compared similar titles, the results were less dramatic, especially at the lower levels of the firm.

Base Salaries Higher in Large Firms

The first place we looked when analysing the differences in compensation by firm size was in base salaries. Here, we found that as firm size increased, base salary also increased. However, the difference was relatively small compared to bonus compensation. There was very little difference in base compensation for employees working at firms with under $200 million in assets under management and those working at firms with $200 million to $1 billion in assets under management. We did notice however a slightly more significant jump as firms crossed the $1 billion mark.

Firm Size More Relevant when it comes to Bonuses

Unlike base compensation, we found a much large disparity when it came to bonuses. Interestingly, small firms actually outperformed their mid-sized peers in 2012. This reverses the trend of the prior year where small firms were the lowest performing when it came to paying out incentive compensation. This is likely due to successful results within the private equity and venture capital industries, as small firms generally have more compensation tied directly to investor results, especially for senior leaders.

Large firms however outperform both their small and medium sized peers by a large margin. The average bonus in a large firm exceeded $250,000 in 2012, compared to an average bonus of just under $100,000 for a small firm. This is a substantial difference and it likely reflects the simple financial reality that large firms have more client dollars per employee that can be paid out in compensation.

Much of the differential in pay came at the higher levels of the organization. Analysts and associates saw marginal increases in pay as firm size increased, but certainly not as significant as senior leaders. Directors and principals saw the biggest pay differentials as firm size increased. This partially reflects the wider scope of responsibility that fund executives have in large firms.

Feb 4, 2013 | Firms

One the major drivers of pay levels in the private equity and venture capital industries is the size of the firm. Firm size has a number of impacts on compensation, from the overall stability of the firm, to level of responsibility assigned to each employee. Generally, larger firms have a more stable client base and therefore more reliable revenue. This allows larger firms to offer more salary based compensation.

On the other side of the equation, in a larger firm, individuals generally operate in specialized roles, without the broad span of responsibilities that those in small firms. The requirement to have a broader business focus and greater responsibility often drives increased compensation demands in smaller firms. The way that small firms meet this demand though is generally through bonus compensation, as their smaller client bases don’t necessarily afford the same level of financial stability to the firm.

Employees at Small Firms saw Higher Compensation in 2012

In 2012, our survey found that the level of compensation within very small firms was increasing at a rate that far outpaced mid-sized and large firms. In past years, compensation had been led by mid-sized firms, offering a balance between span of responsibility and firm financial stability. This year, compensation was led by firms with between one and ten employees. Also interesting was the fact that these small firm employees reported higher salary based earnings than their big firm peers. This may be reflective of small firms recognizing the fact that workload and responsibility is generally greater in small teams, and additional compensation is required in order to retain top talent.

Bonuses were also higher in small firms, but this should come as little surprise as private equity and venture capital firms start to post stronger results. Bonuses are more volatile in small firms due to small revenue bases, and so employees expect to see considerable bonuses in the good years to offset thinner compensation in weak years. The continued strength of the industry should bode well for bonuses amongst small firms in the years to come.

Large Firms may remain most stable

Large firms remain the most stable in providing consistent salary and bonuses to employees. Employees of firms with over 100 staff may not experience the high end bonuses received by small firm employees in good years, but they also don’t have do without during weaker years. Less responsibility and more ability to specialize are also attractive features to some in deciding what firm to work at, and these are qualities that large firms provide. Benefits such as higher vacation are also easier for large firms to deliver, and should be factored into any employment decision.

Jun 25, 2012 | Firms

One of the biggest draw cards to working in the private equity industry is often the large salaries on offer, with average compensation exceeding the $200,000 mark. However, the big compensation offered can often make it difficult to break into the industry, particularly with the top firms and largest funds.

One of the most common questions for those within the private equity industry is ‘Is it really worth the effort to work for larger funds?’. Before you decide to pursue the greater responsibilities and challenges of large funds, you need to identify the value to your career and to your bank account.

After thoroughly researching private equity remuneration, we found that fund size has the ability to affect your pay substantially. No matter where you are in your private equity career, the good news is that working with a larger fund will dramatically boost your salary.

Here are some highlights from the 2012 Private Equity Compensation report:

For those in the earlier stages of their private equity career, fund size doubled compensation.

- Analysts working with large funds (over US$500 mil) received over 89% more compensation than those working with small funds (under US $100 mil)

- Associates working with large funds (over US$500 mil) received 100% more compensation than those with small funds (under US $100 mil) – double the salary of an associate with a small fund

However, the effects of fund size on compensation aren’t just beneficial for analysts and associates. Salary increases were still considerable for all positions in the typical private equity firm:

- Senior associates with large funds had 63% higher salaries than those who worked with small funds (under US $100 mil)

- Directors had a significant pay jump of over 67% when working with a large fund (over US$500 mil), compared to directors working with small funds

- Vice presidents have the biggest increase in compensation: a 191.66% rise in salary

If a higher salary is what you’re looking to achieve, a strategic career move to a larger fund will help you reach your compensation goal. While there will undoubtedly be greater responsibilities associated with the pay increase, working with larger funds will help your bank account, as well as your career by assisting you to develop your skills.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.