Feb 4, 2014 | Bonuses, private equity compensation

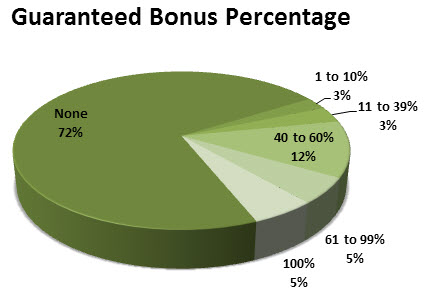

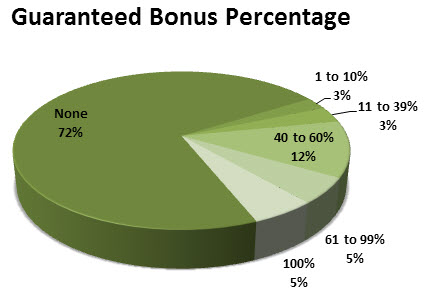

The annual bonus is a large part of compensation in the financial industry and this holds true in both private equity and venture capital firms. Depending on a number of factors, bonuses can range from a most welcome “extra paycheck” at the end of the year to a substantial majority of a professional’s total compensation. Our 2013 Private Equity and Venture Capital Compensation Report identified several factors that influence bonuses in the industry, from fund performance to firm size and job titles. Considering all of these elements is critical when attempting to determine whether a bonus is on market or not.

One of the obvious factors that drive bonus levels in the industry is fund performance. Simply put, a firm experiencing greater success is likely to reward its employees most handsomely. This was certainly one of the leading factors in the differences between reported bonus levels. Top performing funds, earning in excess of 25 percent for their investors, rewarded employees with $151 thousand in incentives in 2012. That compares to only $11,000 being awarded to employees in firms that lost over 10 percent of their value. With a clear trend correlated with performance, it’s safe to assume that the majority of a private equity professional’s bonus will be driven by the returns the fund provides to its investors.

Another factor that weighs on the size of one’s bonus is firm size. While performance can also be somewhat correlated with firm size in some cases, it still holds that both the number of employees and the size of the firm or fund weighs heavily in how much bonus compensation an employee will receive. In general, firms that manage more assets tend to offer higher bonuses despite base compensation being largely the same between firms. On average, an employee at a firm managing $1 billion or more in assets earned a bonus of $250 thousand in 2012, while at a firm with under $200 million in assets an employee would be likely to see $100 thousand in incentive pay.

Somewhat surprising, however, is the impact of the number of firm employees on expected bonus size. The highest bonuses were seen among firms with less than 5 employees. This likely reflects the concentration of senior professionals in smaller firms and a higher reliance on results in order to sustain the very existence of the firm.

The rewarding of senior employees through higher bonus payouts was seen across the industry however, not just in small firms. For example, the average bonus of a Director was around between $100 and $130 thousand per year across all firm sizes, while an associate saw between $24 and $66 thousand. The largest bonus payouts were found in those with Partner and Managing Partner titles, with some big firm leaders earning up to $1.5 million in incentive pay in 2012. Across job titles, a clear trend is evident in that more senior employees will find a larger portion of their pay coming from incentives. This trend likely ties in to their greater influence on firm profits.

With this considered, it’s important to keep in mind all of these factors when evaluating incentive compensation. Bonuses can vary heavily based on these factors. However, performance is always the key driving factor in incentive payouts, whether that’s the performance of the fund or an individual’s own contribution. Successful results are always the best way to ensure a higher bonus payment at the end of the year.

Jan 6, 2014 | Firms

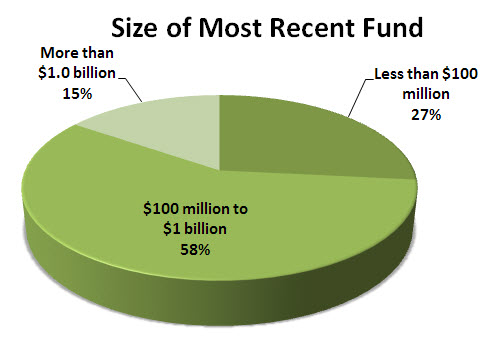

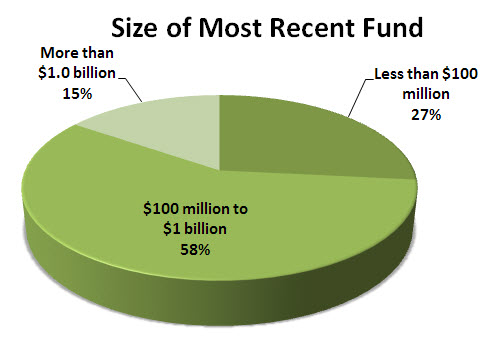

One of the key determining factors in private equity compensation is the size of the fund the professional is working for. Far from a new trend, we have seen this reinforced in numerous surveys dating back several years. However, the differences in compensation practices between funds of varying sizes are more complex than they appear on the surface, and the underlying complexities may be important to those negotiating compensation in the industry.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

However, one complexity is the difference between the size of the firm a professional works for, and the size of the most recent fund offering that firm has launched. We noted less of a differential between firm size than between most recent fund size, which could be a valuable piece of information for job seekers and recruiters alike. So while the gap between large firms and small firms was about $250 thousand in 2012, the gap between those working for a firm that recent launched a large fund and a small fund was only $200 thousand. This 20 percent differential between fund size and firm size may be key to negotiating higher salary when approaching firms that have launched large funds relative to their size.

Of course, compensation depends heavily on title and here we saw discrepancy between fund sizes as well. As a firm grows, not all positions within the firm seem to benefit from the overall higher trend in total compensation. Those at the higher levels of a firm seem to benefit most from the overall growth in compensation. Principals saw the highest differential, well over 100 percent, in total compensation between small firms and large firms. This is likely due to higher incentive pay amongst senior leaders due to the successful growth of the firm. On the other hand, analysts saw very little difference in compensation between small and large firms, earning only about 25 percent more at large funds.

As we can see, while on the surface it seems simple to suggest that those working for large firms earn more than their small shop counterparts, complexities certainly make the comparison more difficult. Differences in recently launched fund sizes and in position within the organization cloud the overall picture. In order to accurately negotiate compensation, such details need to be factored in by human resources professionals and job seekers alike.

May 27, 2013 | Culture

One of the most important factors in retaining top talent in the financial industry is employee satisfaction with their compensation arrangements. Despite this being such a critical leading indicator of potential turnover issues, many firms in the industry do not actively survey their employees on how happy they are with their pay. This can be a critical mistake for firms, especially as the demand for top talent increases as the private equity and venture capital industries grow.

Perhaps not surprisingly, we’ve found that overall pay satisfaction is highly correlated with overall job market conditions within the industry. During times of struggle and declining employment, pay satisfaction tends to increase. However, once the economy heats up and jobs become more numerous, it seems as though employees grow increasingly interested in how much their peers are earning across the street.

2013 Survey Showed an Upward Trend in Satisfaction

That said, despite increased hiring intentions and a relatively robust industry, we’ve seen a markedly upward trend in satisfaction with compensation. According to our 2013 survey, 56 percent of respondents reported they were happy with their pay packages, which is up from 41 percent and 36 percent in the last two years respectively. As the over trends in hiring intentions and employment seem positive, we suspect that the considerable growth in average industry compensation this year is likely a driving factor behind the satisfaction numbers we’ve recorded. However, if our historical understanding of compensation satisfaction holds however, we would expect to see this number begin to decline as hiring intentions begin to shift into real competition for top industry talent.

It is also important to note that satisfaction with pay can fluctuate wildly throughout the year, perhaps with employees feeling underpaid at peak workload periods and adequately compensated during less intense periods. Even a bad day in the office can impact whether someone perceives themselves as being fairly paid.

Overall, the private equity and venture capital industries do reward the hard work of their employees with exceptional compensation. In a broader United States or global employment context, the industry is amongst the most highly compensated in the world. However, that doesn’t mean that some individuals can feel slighted, with much of the dissatisfaction present in the industry is simply competitive tensions and employees wondering if they could make more at another firm. Managing this dissatisfaction is critical to firms that are looking to retain their top talent as competition in the industry heats up.

Mar 11, 2013 | Industry

When it comes to compensation differences between private equity and venture capital firms, our survey found some interesting trends. In 2012, financial professionals were much better off, on average, in terms of compensation when working for a private equity firm than for a venture capital firm.

Differences were most noticeable at the top of the corporate ladder. At the principal level, an individual working in private equity could expect to earn approximately $450,000 a year, while his peer in venture capital would expect, on average, approximately $210,000 per year in total compensation. At the managing director level, the same trend was apparent, with the private equity employee earning about $200,000 more per year on average than a comparable individual in venture capital. Even at the lower levels within the organizations, compensation differences were certainly visible. At the associate level, the private equity employee could expect to earn approximately $30,000 more per year than a comparable employee working in the venture capital space. The gap declined substantially at the senior associate level, however, and then began to increase again as we surveyed the more senior ranks.

At both the top and bottom of the organizations, those working in firms that handled both private equity and venture capital type activities tended to be compensated more in line with the higher paid private equity employees. This is not unexpected, as most firms that operate in both spaces would generally describe themselves as a private equity manager first, with venture capital activities providing a secondary role.

In both private equity and venture capital, we did see increases in year over year total compensation, primarily related to bonuses. This reflects an overall shift within the financial industry to more performance based compensation, more closely aligning firm results with the results of investors.

Reason for Differences may relate to Firm Size, Location

The reason for these differences is unclear, but there are a few reasonable hypothesises available. First, private equity firms tend to be larger in size, and elsewhere in our survey, we found those working for larger firms to be paid more than those working in smaller outfits. In addition, private equity firms are, in general, more likely to be located in traditional financial regions such as New York, which generally have higher costs of living and therefore higher expected compensation. While these reasons are certainly not conclusive, they may provide some hints to what drives the compensation gap.

Feb 25, 2013 | Firms

When it comes to private equity and venture capital careers, the size of the company you work for is a key variable in determining how much you’re likely to be paid. According to the findings of our 2013 Private Equity and VC Compensation Report, those working at large firms, defined as those with greater than $1 billion in assets under management, expected to see 81 percent more compensation on average than their small firm peers. While this number may seem shocking on the surface, this is a composite of all respondents. When we compared similar titles, the results were less dramatic, especially at the lower levels of the firm.

Base Salaries Higher in Large Firms

The first place we looked when analysing the differences in compensation by firm size was in base salaries. Here, we found that as firm size increased, base salary also increased. However, the difference was relatively small compared to bonus compensation. There was very little difference in base compensation for employees working at firms with under $200 million in assets under management and those working at firms with $200 million to $1 billion in assets under management. We did notice however a slightly more significant jump as firms crossed the $1 billion mark.

Firm Size More Relevant when it comes to Bonuses

Unlike base compensation, we found a much large disparity when it came to bonuses. Interestingly, small firms actually outperformed their mid-sized peers in 2012. This reverses the trend of the prior year where small firms were the lowest performing when it came to paying out incentive compensation. This is likely due to successful results within the private equity and venture capital industries, as small firms generally have more compensation tied directly to investor results, especially for senior leaders.

Large firms however outperform both their small and medium sized peers by a large margin. The average bonus in a large firm exceeded $250,000 in 2012, compared to an average bonus of just under $100,000 for a small firm. This is a substantial difference and it likely reflects the simple financial reality that large firms have more client dollars per employee that can be paid out in compensation.

Much of the differential in pay came at the higher levels of the organization. Analysts and associates saw marginal increases in pay as firm size increased, but certainly not as significant as senior leaders. Directors and principals saw the biggest pay differentials as firm size increased. This partially reflects the wider scope of responsibility that fund executives have in large firms.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.