Nov 30, 2024 | private equity compensation

Unveiling the 2025 Private Equity & VC Compensation Report: Key Trends, Insights, and Industry Benchmarks

This year’s 2025 Private Equity & Venture Capital Compensation Report marks nearly two decades of providing insights into the dynamic compensation trends shaping the industry. Despite a challenging economic backdrop and global market uncertainties, compensation across private equity and venture capital roles has remained resilient, reflecting the sector’s adaptability and strong competition for top-tier talent.

Total compensation levels continue to climb, with base salaries driving much of the growth. Bonus payouts, however, showed more mixed trends, influenced by fund performance, firm size, and individual contributions. For the first time, 90% of respondents reported earning more than $150,000 annually, setting a new record for industry-wide pay distribution.

While higher pay remains a hallmark of the sector, 62% of professionals reported an increase in total cash compensation this year. Yet, bonus growth varied significantly across firm sizes, with the largest payouts concentrated in firms managing over $1 billion in assets. Bonuses remain predominantly tied to performance, and most firms continue the trend of annual payouts between December and March.

The preference for lean, agile team structures remains a defining characteristic of the industry, with 85% of respondents working in teams of fewer than 25 people. However, this focus on efficiency underscores a persistent weakness: training and professional development programs. Half of respondents rated their firm’s training resources as inadequate, a trend unchanged from prior years.

Key compensation differences persist between private equity and venture capital firms, with hybrid firms offering some of the most competitive packages for senior roles. Venture capital professionals, while typically earning less than their private equity counterparts, saw the largest year-over-year increases in bonus pay.

Hiring patterns reflect cautious optimism, as firms selectively recruit for high-demand positions, particularly in investment roles. At the same time, reductions in headcount across some areas suggest strategic realignments as firms adapt to shifting market conditions.

Other notable findings from this year include:

- Pay Satisfaction: While many senior leaders remain satisfied with their earnings, mid-level professionals, particularly Investment Managers and Associates, expressed growing dissatisfaction.

- Bonus Guarantees: Just 29% of respondents reported receiving any form of guaranteed bonus, consistent with prior years.

- Carry Allocations: Executive-level carry participation saw incremental growth, with a 4% rise in allocations exceeding 10% of the pool.

- Fund Performance Trends: Funds achieving returns of 10-24% gained ground, but the percentage of top-performing funds continued to shrink, reflecting broader market volatility.

- Work-Life Balance: Satisfaction with work-life balance remained steady, with 40% reporting above-average or excellent experiences in this area.

The 2025 report offers a comprehensive overview of compensation practices in private equity and venture capital, providing a reliable benchmark for industry professionals. Whether you are negotiating your next role, refining your firm’s pay policies, or planning career moves, this report offers invaluable data and insights.

Dec 5, 2022 | private equity compensation

2023 Private Equity Compensation Report Shows Increased Compensation Despite Slowing Fund Performance

ANN ARBOR, MI, December 7, 2022 – The 2023 Private Equity and Venture Capital Compensation Report marks the ninth straight year of compensation gains in the private equity and venture capital industry.

Despite a downturn in the stock market, corporate layoffs, and discussions of recession, participants across the board reported higher total earnings over the previous year. Overall, 65 percent of respondents expect to see greater cash earnings this year.

Those earning from $151,000 to $1 million increased another 3 percent and now account for 87 percent of respondents. This is the highest percentage of private equity and venture capital professionals reporting earnings of more than $150,000 in annual compensation in the history of this report.

“As we saw last year, most of these professionals are unhappy with their private equity compensation packages,” said David Kochanek, Publisher of PrivateEquityCompensation.com. “Market conditions and employee expectations were the two biggest reasons cited for their dissatisfaction.” Carried interest and compensation formulas were the remaining reasons for dissatisfaction.

Estimated fund performance in 2022 is down compared to last year. Funds up 25 percent or more fell by 4 percent. Funds up 10 to 24 percent dropped from 45 percent last year to 39 percent. And the percentage of respondents who said their fund’s performance was down increased from 4 to 8 percent. Given the state of the economy, we expect this trend to continue in 2023.

Bonus pay is usually based on several factors, including firm performance, fund performance, and individual performance. As reported in previous reports, this year, when funds didn’t perform well, professionals expected their firm to pay out lucrative bonuses to team members.

The most popular month for bonus payouts is December, accounting for 26 percent of responses. December is followed by the first three months of the year, in which 49 percent of respondents report receiving their bonus payouts.

In-house training continues to receive unfavorable reviews, with nearly half of respondents reporting non-existent or weak internal training programs. Equivalent to last year, only 18 percent rate their in-house training as good to excellent despite the benefits firms could gain in recruitment and retention by strengthening this area.

In addition to compensation data, the 2023 Private Equity and Venture Capital Compensation Report provides additional insights such as positions in demand, percentage of firms hiring, where firms are cutting back, and where career opportunities are increasing.

About The Report

The 2023 Private Equity and Venture Capital Compensation Report is based on data collected directly from hundreds of private equity and venture capital partners, principals, and employees.

The report, in its sixteenth year of publication, is widely regarded to be among the most comprehensive benchmarks for private equity and venture capital compensation. It provides independent and impartial data covering a broad range of salary, bonus, carried interest, and other compensation-related information, sourced directly from professionals working within the industry.

Dec 19, 2021 | private equity compensation

2022 Private Equity Compensation Report Shows Continued Upward Trends in Compensation

ANN ARBOR, MI – The 2022 Private Equity and Venture Capital Compensation Report shows that private equity and venture capital compensation is up again this year, marking the eighth straight year of compensation gains.

The percentage of respondents earning $150,000 and below has continued to decline and those earning from $151,000 to $1 million increased to 80 percent of respondents. This is the highest percentage of private equity and venture capital professionals reporting earnings more than $150,000 in annual compensation in the history of this report.

“Overall, compensation is up, yet 57 percent of those surveyed are dissatisfied with their pay,” said David Kochanek, Publisher of PrivateEquityCompensation.com. “We’ve seen this before. When the market is strong, pay satisfaction is weak. This is because investment professionals are not currently concerned about losing their job and they are reading about the top performers and huge pay packages.” Market conditions and employee expectations are the reasons cited by 62 percent of those dissatisfied.

Estimated fund performance in 2021 was up compared to 2020, and funds up 10 to 24 percent over last year represented the majority at 45 percent.

The research shows that bonus pay is typically calculated based on firm performance, fund performance, individual performance and a combination of factors. The largest bonus payouts are achieved in the largest firms based on individual performance. In fact, employees at the largest firms can expect to earn more than triple the bonus pay of those at smaller firms.

In addition to compensation data, the 2022 Private Equity and Venture Capital Compensation Report provides additional insights such as positions in demand, percentage of firms hiring, where firms are cutting back and where career opportunities are increasing.

About The Report

The 2022 Private Equity and Venture Capital Compensation Report is based on data collected directly from hundreds of private equity and venture capital partners, principals and employees.

The report, in its fifteenth year of publication, is widely regarded to be among the most comprehensive benchmarks for private equity and venture capital compensation. It provides independent and impartial data covering a broad range of salary, bonus, carried interest and other compensation-related information, sourced directly from professionals working within the industry.

Apr 26, 2021 | private equity compensation

Continued Upward Trend in Compensation Despite COVID-19 Pandemic

ANN ARBOR, MI, April 27, 2020 — The 2021 Private Equity and Venture Capital Compensation Report shows that private equity and venture capital compensation is up again this year, marking the seventh straight year of compensation gains. The year was unprecedented with the COVID-19 pandemic, and many respondents noted concerns about fundraising and job security in this environment.

The percentage of respondents earning less than $150,000 was down again and those earning from $150,000 to $1 million increased to 68 percent of respondents. This represents the highest percentage of private equity and venture capital professionals reporting earnings more than $150,000 in annual compensation in the history of this report.

“Overall, compensation is up, but more than half of those surveyed are dissatisfied with their pay,” said David Kochanek, Publisher of PrivateEquityCompensation.com. Market conditions and employee expectations are the reasons cited by 60 percent of those dissatisfied.

Bonus pay in the highest pay band has been declining as a percentage share of total compensation since 2014. In fact, bonus pay went down for most respondents compared to last year. However, employees at the largest firms can expect to earn more than double the bonus pay of those at smaller firms.

The research shows that private equity bonus pay is typically calculated based on a combination of several factors: firm performance, fund performance, and individual performance. The highest percentage of firms use a combination of factors but the largest bonus payouts are achieved in the largest firms based on firm performance.

For private equity job seekers, the 2021 Private Equity and Venture Capital Compensation Report provides additional detail such as positions in demand, percentage of firms hiring, where firms are cutting back and where career opportunities are increasing.

About The Report

The 2021 Private Equity and Venture Capital Compensation Report is based on data collected directly from hundreds of private equity and venture capital partners, principals and employees.

The report, in its fourteenth year of publication, is widely regarded to be among the most comprehensive benchmarks for private equity and venture capital compensation. It provides independent and impartial data covering a broad range of salary, bonus, carried interest and other compensation-related information, sourced directly from professionals working within the industry.

Dec 15, 2018 | private equity compensation

Private Equity and Venture Capital Compensation Gains Continue

In this, our twelfth annual Private Equity & Venture Capital Compensation Report for 2019, we look to that past to better confront the challenges of the future. The goal of this report is to identify industry compensation trends and provide insights into their effect on compensation practices, recruitment and retention.

In this, our twelfth annual Private Equity & Venture Capital Compensation Report for 2019, we look to that past to better confront the challenges of the future. The goal of this report is to identify industry compensation trends and provide insights into their effect on compensation practices, recruitment and retention.

This year marks the fifth straight year of compensation gains in the private equity and venture capital industry, with 64 percent of this year’s respondents expecting total compensation levels to increase over last year, while only 5 percent expect to earn less.

We have noted several trends in this year’s compensation report, one of which is increasing base salaries and declining bonuses as a percentage of overall compensation for private equity and venture capital professionals in the highest pay band.

This year’s report confirms the continuation of another unsettling trend—the diminishing correlation between bonus pay and firm performance. For example, we see that respondents employed in firms where fund performance is down by 1 to 9 percent still forecast an average bonus of $114,000. Seeds of this trend surfaced in 2014, sprouted in 2015, grew in 2016 and matured in 2018.

In-house training continues to receive unfavorable reviews, despite last year’s movement in a positive direction. Why the industry ignores the potential benefits of robust in-house training programs remains a mystery, particularly in the competitive job market that exists today. Quality internal training programs have the potential to attract and retain talent, but statistics show this potential is broadly ignored, as a mere 17 percent of this year’s respondents rate their in-house training as good to excellent.

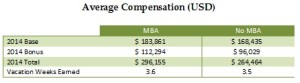

Higher MBA base salary, bonus compensation, and vacation time as compared to their non-MBA peers has been a regular feature of this report since its inception. This year, we can once again, confirm the monetary value of an advanced degree.

Job seekers will appreciate the section of this report devoted to identifying which positions are in demand, what percentage of firms are hiring, and what percentage are cutting back. For example, 54 percent of respondents’ firms are hiring investment personnel, while only 1 percent are cutting back in information technology hires.

The 2019 Private Equity and Venture Capital Compensation Report serves as myth-buster and forecaster, debunking misconceptions, and providing readers insightful, industry-specific information regarding the complex subject of compensation.

Other highlights from this year’s report include:

- Respondents working in firms with less than $100 million in assets under management (AUM) earn almost 13 percent less than peers in firms with $1 billion or more;

- 73 percent of respondents do not receive a bonus guarantee;

- The least-favored investment strategy is PIPE;

- Bonus pay totals 44 percent of all compensation paid to industry professionals; and

- Fifty-two percent of respondents work in firms with expected fund gains of 10 to 24 percent.

About The Private Equity Compensation Report

The 2018 Private Equity and Venture Capital Compensation Report is based on data collected directly from hundreds of private equity and venture capital partners, principals and employees.

The report, in its eleventh year of publication, is widely regarded to be among the most comprehensive benchmarks for private equity and venture capital compensation. It provides independent and impartial data covering a broad range of salary, bonus, carried interest and other compensation related information, sourced directly from professionals working within the industry.

Dec 17, 2017 | Press

Continued Demand for Investment Talent is Driving New Levels of Compensation

The 2018 Private Equity Compensation Report, shows that increased fund raising and billions in funds looking for investments has resulted again this year in increased private equity and venture capital compensation.

The 2018 Private Equity Compensation Report, shows that increased fund raising and billions in funds looking for investments has resulted again this year in increased private equity and venture capital compensation.

Sixty-five percent of professionals reported an increase in cash earnings this year. The average reported cash compensation for private equity and venture capital professionals is $315,000 USD, another increase from the previous year. Private equity and venture capital professionals working in the largest firms continue to out-earn their peers in smaller firms.

North American dry powder levels are now measured in the hundreds of billions of dollars. The report reveals increased demand for investment talent again this year. “We predicted this trend several years ago based on private equity professionals reporting increases in both base and bonus, despite their funds not producing outstanding returns,” said David Kochanek, Publisher of PrivateEquityCompensation.com

The correlation between bonus pay and firm performance continues to diminish. In 2017, it became apparent that the absence of close correlation is the new normal. In this 2018 report, we see that respondents employed in firms whose performance is down by 1 to 9 percent still forecast an average bonus of $161,000.

For private equity job seekers, the Private Equity Compensation Report for 2018 reveals which positions are in demand, what percentage of firms are hiring, and where firms are cutting back – and the career opportunities are increasing across the board. For example, 25 percent of respondents’ firms are hiring in the back office for accounting personnel and 27 percent said they are hiring in operations and portfolio management.

As seen in prior years, when the demand for talent is high, the level of satisfaction with overall compensation is low. Again this year, more than half of respondents described their compensation as unsatisfactory, including some principals, managing directors and senior analysts.

Firms would be wise to tune into their team’s thoughts on compensation levels right now. “Often times, the first indication of a problem is when the employee turns in their 2-week notice and is headed out to join another firm,” Kochanek warns.

About The Report

The 2018 Private Equity and Venture Capital Compensation Report is based on data collected directly from hundreds of private equity and venture capital partners, principals and employees.

The report, in its eleventh year of publication, is widely regarded to be among the most comprehensive benchmarks for private equity and venture capital compensation. It provides independent and impartial data covering a broad range of salary, bonus, carried interest and other compensation related information, sourced directly from professionals working within the industry.

Jan 20, 2016 | Press

The Private Equity Compensation Report for 2016 Uncovers Disconnect Between Fund Performance and Cash Bonuses

Cash increases slow while the demand for private equity talent increases.

SAN DIEGO, CA, January 20, 2016 — The 2016 Private Equity & Venture Capital Compensation Report, released today, shows that slower industry activity is reflecting in private equity and venture capital pay.

Although 65 percent of professionals reported an increase in expected salaries and bonuses, the growth in cash compensation has slowed. This year’s average compensation for private equity and venture capital professionals was $272,000 USD, a slight decrease from last year.

This marks the second consecutive year of diminished correlation between bonus pay and firm performance. Respondents working in  firms that were down 10 percent or more, report anticipated bonuses averaging $43,000 USD. This disconnect continued to surface in firms down 1 to 9 percent, with these survey participants expecting bonuses to average $94,000. In contrast, respondents working in firms that realized gains between 1 to 9 percent were expecting an average $91,000 in bonus pay, $3,000 less than their counterparts in firms that were down by the same range.

firms that were down 10 percent or more, report anticipated bonuses averaging $43,000 USD. This disconnect continued to surface in firms down 1 to 9 percent, with these survey participants expecting bonuses to average $94,000. In contrast, respondents working in firms that realized gains between 1 to 9 percent were expecting an average $91,000 in bonus pay, $3,000 less than their counterparts in firms that were down by the same range.

The private equity job market, however, continues to shine. “Funds are looking to put their capital to work, that means deal sourcing talent is at a premium,” said David Kochanek, Publisher of PrivateEquityCompensation.com. This year’s report reveals that 45 percent of firms are looking to hire additional investment professionals.

Says Kochanek, “With all the dry powder firms are sitting on, we were not surprised to see increased demand for investment talent again this year. Further, based on the expensive multiples seen in recent strategic exits, we won’t be surprised to see demand increase over the next 12 months for professionals with deep due diligence experience.”

As seen in prior years, when the demand for talent is high, the level of satisfaction with overall compensation is low. Again this year, more than half of respondents described their compensation as unsatisfactory.

About The Report

The 2016 Private Equity and Venture Capital Compensation Report is based on data collected from hundreds of private equity and venture capital partners, principals and employees through direct surveys. The report, in its ninth year of publication, is widely regarded to be among the most comprehensive benchmarks for private equity and venture capital compensation. It opens the door to trusted, independent and impartial data covering a broad range of salary, bonus, carried interest and other compensation related information, sourced from respondents working within the industry.

Some of the participating firms over the years include: Alpinvest Partners, American Capital, Battery Ventures, BlackRock, Carlyle, Century Capital Management, Cerberus, Comcast Ventures, DuPont Capital Management, EdgeStone Capital Partners, GE, Guggenheim Partners, Highland Capital Partners, Hilco Consumer Capital, Intel Capital, Mission Ventures, Mohr Davidow, North Atlantic Capital, RBC Capital Partners, RBS, Safeguard Scientifics, SV Life Sciences, Siemens Venture Capital, TPG, Venrock, and Warburg Pincus.

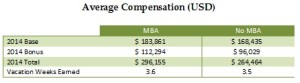

Mar 12, 2015 | MBA

One question that many private equity and venture capital professionals are faced with is whether or not to pursue further graduate level education. From a purely financial standpoint, individuals must weigh the costs of MBA programs and the future compensation advantages they may generate. But the decision is not purely financial. Professionals also must way the value of a new network for finding exciting opportunities, and the personal development gained along the way.

From the financial angle, our 2015 Private Equity and Venture Capital Compensation Report did find an advantage for MBA holders when it came to total compensation. In 2013, respondents with an MBA indicated they earned 19 percent more than their non-MBA peers. However, in the most recent survey, we saw this gap narrow to only 12 percent.

An interesting trend that we’ve noted in the past is that the gap in compensation is driven more by base compensation than it is by bonuses. One possible driver of this differential in base compensation may be that those with MBAs have greater access to the best positions through their well-developed networks. In addition, the credential may open up more senior level positions where base compensation is stronger, depending on the firm and individual’s experience. However this year, we saw that gap close among our survey respondents. In a stronger job market, the MBA may hold less of an advantage than what seemed to exist in leaner times where every possible edge was necessary to land top roles.

On the other hand, however, bonuses have been are largely comparable between those with and without an MBA for some time. Bonuses are driven largely by firm and individual performance. While an MBA may have some additional developed skills through their education, this may not be enough to dramatically tip the scales when it comes to bonuses. MBAs did earn higher bonuses than their non-MBA peers in 2014, both in nominal dollars and as a percentage of total compensation. Relative to total pay, however, the advantage was marginal.

Of course, pursuing an MBA to further one’s career in Private Equity or Venture Capital comes at a high cost. Top MBA programs can run about one-hundred thousand dollars, not including foregone earnings, so future graduates must be confident in their ability to land a role that can pay for this investment upon graduation. In many cases, this isn’t the reality, leaving the benefits of the MBA more intangible to some graduates.

Mar 5, 2015 | Firms

Many professionals in the private equity and venture capital industry wonder whether a potential move to a larger or smaller firm may result in higher compensation. According to the latest results from our 2015 Private Equity and Venture Capital Compensation Report, the overall difference in compensation in 2014 between firm sizes is marginal at best. However, this has not always been the case, and different compensation levels between firm sizes have been noted in previous reports.

Looking at our 2014 data, those working at firms with between 50 to 99 employees tended to earn the highest total compensation. However, these same professionals did not earn the highest salaries, which were reserved for those at firms with 10 to 24 employees. As firm size increased, we saw notable bonus compensation increases offset somewhat by a decline in base compensation. The one exception to this trend was compensation at the largest firms, with over 100 employees. In this example, we found that total compensation was lower than mid-size peers in both bonuses and base pay.

In the past, we noted a stronger U-shape to the profile of total compensation by firm size. Those working at the smallest and largest firms tended to earn the highest compensation, while those at mid-size firms earned the least. This was partially explained by the reality that those at the smallest firms often have to wear many hats and carry a variety of responsibilities, while those at the largest firms benefited from the most stable client revenue streams, allowing their firms to offer higher total compensation.

The robust job market, which we have seen continue to strengthen in our survey results, is a key contributing factor to the flattening of the compensation profile by firm size. When high performing employees have the ability to jump ship to other firms, it forces all players to be more competitive in their total compensation offerings in order to retain their top talent.

Another factor in increasing pay equity across different firm sizes may be the additional transparency when it comes to compensation in the industry. Reports such as ours, and other data sources, allow professionals to better negotiate their pay within industry norms. On the flip side, companies are also better informed in offering pay packages within the ranges.

As long as we continue to experience a robust market, this trend is likely to continue in 2015. With both professionals and firms having better access to compensation data, and job opportunities aplenty, parity among firm sizes in compensation may be a trend that is here to stay, at least for the medium term.

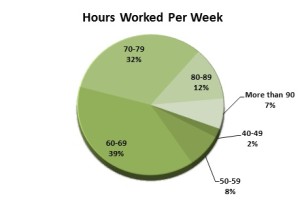

Feb 26, 2015 | Culture

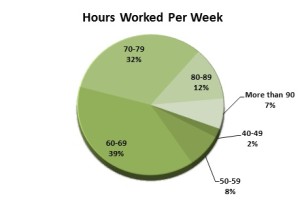

Those in any segment of the financial industry are no stranger to long hours in the office. However, over the past several years, our Private Equity and Venture Capital Compensation Report found that the total hours worked per week by professionals in this segment of the industry had declined, and in some cases, substantially. In 2014, however, we noted a considerable reversal of this trend, raising questions about what changed and why.

When it came down to the details, we found that 51 percent of respondents to our survey worked at least 70 hours to week. This is a major jump in the number of respondents from this cohort, up from only 20 percent of respondents in the prior year’s survey. However, this data needs to be interpreted carefully, as a slight increase in the number of hours may bump a large percentage of people into another range band in our results. That said, there is a clear increase across the board in the number of hours professionals are spending in the office.

While on the surface some may consider this evidence of a slowing job market, where employees need to work harder to prove their worth, our other data does not support this. Hiring intentions are jump, and fund performance is strong. External data providers, such as Preqin, as indicating investor interest in private equity is improving, not weakening. This leads us to believe that this increase in hours worked may be reflective of positive trends in the industry, with lots of work to do and more deals being closed. The increasing demands on staff will be a positive factor in salary negotiations in coming years, and a tighter labor market with more firms hiring will only contribute to both increased hours in the office and increased salaries.

It’s important to note that those that work the highest hours do not necessarily make the most money per hour worked. In line with previous year’s results, our survey found those working in excess of 90 hours per week made on average $250 per hour, while those at 70 hours per week earned the most, $306 per hour. One important consideration is that hours worked may also reflect one’s position in the organization. Trying to prove oneself as an analyst may require more hours than the work of a Managing Director, even though that too is a demanding role when it comes to office time. These positional differences may account for a portion of the variance we see when it comes to pay per hour worked.

The 2018 Private Equity Compensation Report, shows that increased fund raising and billions in funds looking for investments has resulted again this year in increased private equity and venture capital compensation.

The 2018 Private Equity Compensation Report, shows that increased fund raising and billions in funds looking for investments has resulted again this year in increased private equity and venture capital compensation. firms that were down 10 percent or more, report anticipated bonuses averaging $43,000 USD. This disconnect continued to surface in firms down 1 to 9 percent, with these survey participants expecting bonuses to average $94,000. In contrast, respondents working in firms that realized gains between 1 to 9 percent were expecting an average $91,000 in bonus pay, $3,000 less than their counterparts in firms that were down by the same range.

firms that were down 10 percent or more, report anticipated bonuses averaging $43,000 USD. This disconnect continued to surface in firms down 1 to 9 percent, with these survey participants expecting bonuses to average $94,000. In contrast, respondents working in firms that realized gains between 1 to 9 percent were expecting an average $91,000 in bonus pay, $3,000 less than their counterparts in firms that were down by the same range.