Mar 12, 2015 | MBA

One question that many private equity and venture capital professionals are faced with is whether or not to pursue further graduate level education. From a purely financial standpoint, individuals must weigh the costs of MBA programs and the future compensation advantages they may generate. But the decision is not purely financial. Professionals also must way the value of a new network for finding exciting opportunities, and the personal development gained along the way.

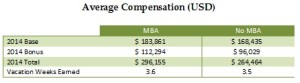

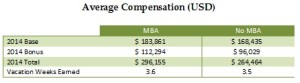

From the financial angle, our 2015 Private Equity and Venture Capital Compensation Report did find an advantage for MBA holders when it came to total compensation. In 2013, respondents with an MBA indicated they earned 19 percent more than their non-MBA peers. However, in the most recent survey, we saw this gap narrow to only 12 percent.

An interesting trend that we’ve noted in the past is that the gap in compensation is driven more by base compensation than it is by bonuses. One possible driver of this differential in base compensation may be that those with MBAs have greater access to the best positions through their well-developed networks. In addition, the credential may open up more senior level positions where base compensation is stronger, depending on the firm and individual’s experience. However this year, we saw that gap close among our survey respondents. In a stronger job market, the MBA may hold less of an advantage than what seemed to exist in leaner times where every possible edge was necessary to land top roles.

On the other hand, however, bonuses have been are largely comparable between those with and without an MBA for some time. Bonuses are driven largely by firm and individual performance. While an MBA may have some additional developed skills through their education, this may not be enough to dramatically tip the scales when it comes to bonuses. MBAs did earn higher bonuses than their non-MBA peers in 2014, both in nominal dollars and as a percentage of total compensation. Relative to total pay, however, the advantage was marginal.

Of course, pursuing an MBA to further one’s career in Private Equity or Venture Capital comes at a high cost. Top MBA programs can run about one-hundred thousand dollars, not including foregone earnings, so future graduates must be confident in their ability to land a role that can pay for this investment upon graduation. In many cases, this isn’t the reality, leaving the benefits of the MBA more intangible to some graduates.

Mar 5, 2015 | Firms

Many professionals in the private equity and venture capital industry wonder whether a potential move to a larger or smaller firm may result in higher compensation. According to the latest results from our 2015 Private Equity and Venture Capital Compensation Report, the overall difference in compensation in 2014 between firm sizes is marginal at best. However, this has not always been the case, and different compensation levels between firm sizes have been noted in previous reports.

Looking at our 2014 data, those working at firms with between 50 to 99 employees tended to earn the highest total compensation. However, these same professionals did not earn the highest salaries, which were reserved for those at firms with 10 to 24 employees. As firm size increased, we saw notable bonus compensation increases offset somewhat by a decline in base compensation. The one exception to this trend was compensation at the largest firms, with over 100 employees. In this example, we found that total compensation was lower than mid-size peers in both bonuses and base pay.

In the past, we noted a stronger U-shape to the profile of total compensation by firm size. Those working at the smallest and largest firms tended to earn the highest compensation, while those at mid-size firms earned the least. This was partially explained by the reality that those at the smallest firms often have to wear many hats and carry a variety of responsibilities, while those at the largest firms benefited from the most stable client revenue streams, allowing their firms to offer higher total compensation.

The robust job market, which we have seen continue to strengthen in our survey results, is a key contributing factor to the flattening of the compensation profile by firm size. When high performing employees have the ability to jump ship to other firms, it forces all players to be more competitive in their total compensation offerings in order to retain their top talent.

Another factor in increasing pay equity across different firm sizes may be the additional transparency when it comes to compensation in the industry. Reports such as ours, and other data sources, allow professionals to better negotiate their pay within industry norms. On the flip side, companies are also better informed in offering pay packages within the ranges.

As long as we continue to experience a robust market, this trend is likely to continue in 2015. With both professionals and firms having better access to compensation data, and job opportunities aplenty, parity among firm sizes in compensation may be a trend that is here to stay, at least for the medium term.

Feb 26, 2015 | Culture

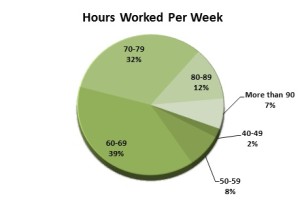

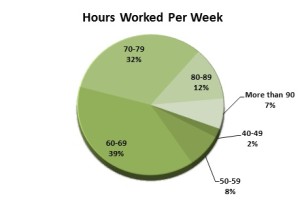

Those in any segment of the financial industry are no stranger to long hours in the office. However, over the past several years, our Private Equity and Venture Capital Compensation Report found that the total hours worked per week by professionals in this segment of the industry had declined, and in some cases, substantially. In 2014, however, we noted a considerable reversal of this trend, raising questions about what changed and why.

When it came down to the details, we found that 51 percent of respondents to our survey worked at least 70 hours to week. This is a major jump in the number of respondents from this cohort, up from only 20 percent of respondents in the prior year’s survey. However, this data needs to be interpreted carefully, as a slight increase in the number of hours may bump a large percentage of people into another range band in our results. That said, there is a clear increase across the board in the number of hours professionals are spending in the office.

While on the surface some may consider this evidence of a slowing job market, where employees need to work harder to prove their worth, our other data does not support this. Hiring intentions are jump, and fund performance is strong. External data providers, such as Preqin, as indicating investor interest in private equity is improving, not weakening. This leads us to believe that this increase in hours worked may be reflective of positive trends in the industry, with lots of work to do and more deals being closed. The increasing demands on staff will be a positive factor in salary negotiations in coming years, and a tighter labor market with more firms hiring will only contribute to both increased hours in the office and increased salaries.

It’s important to note that those that work the highest hours do not necessarily make the most money per hour worked. In line with previous year’s results, our survey found those working in excess of 90 hours per week made on average $250 per hour, while those at 70 hours per week earned the most, $306 per hour. One important consideration is that hours worked may also reflect one’s position in the organization. Trying to prove oneself as an analyst may require more hours than the work of a Managing Director, even though that too is a demanding role when it comes to office time. These positional differences may account for a portion of the variance we see when it comes to pay per hour worked.

Feb 19, 2015 | Performance

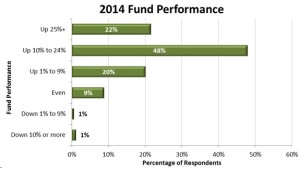

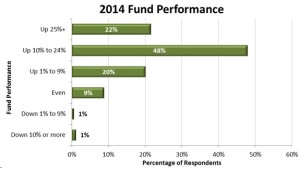

After a year of strong performance in the sector, private equity and venture capital professionals posted some remarkable pay gains in 2014. While the S&P 500 posted a fairly strong total return of 14 percent in 2014, the majority of our respondents indicated their funds were likely to beat these equity benchmarks for the year.

Investors looking for diversification along with higher returns compared to other possible alternative asset classes are increasingly looking to private equity as a solution. According to Preqin, 57 percent of private equity firms said they saw increased investor appetite over the last year, while only 12 percent of firms said they saw reduced interest. In an industry where management fees, based on assets under management, drive the bottom line for firms, the increased amount of capital available is one factor in driving up compensation in the industry. Sustained interest in the segment will continue to allow for improved compensation among top performing firms.

Behind all of this investor interest and new money, of course, is performance. Our survey respondents at private equity and venture capital funds indicated their funds were expected to post stronger returns in 2014 than they did the prior year. At the upper end of the spectrum, 22 percent of respondents indicated their 2014 performance would exceed 25 percent, up 6 percentage points from the prior year. This strong performance is one factor driving compensation higher this year. And in light of increasing volatility in equity markets, the relative stability of private equity returns will be attractive to investors in the coming year.

There is also a correlation between fund performance and bonuses, which comprise a large portion of the total compensation for all finance industry professionals. Our survey results indicated that the strongest performing funds also awarded the largest bonuses to their professionals, as expected. With the highest paid professionals earning sometimes the majority of their compensation through bonuses, fund performance can clearly have a large influence on total compensation payouts.

The coming year looks to be promising for private equity and venture capital firms, and their employees, if performance can be maintained at or near these levels. Increasing equity market volatility will encourage more investors to consider the more stable and long term focused returns consistent with private equity strategies. Firms successful in capturing this investor interest by building their assets under management will likely be the leaders in increasing compensation available to their employees, in order to attract and retain top talent.

May 20, 2014 | Culture

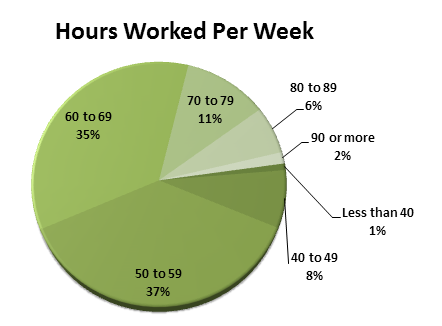

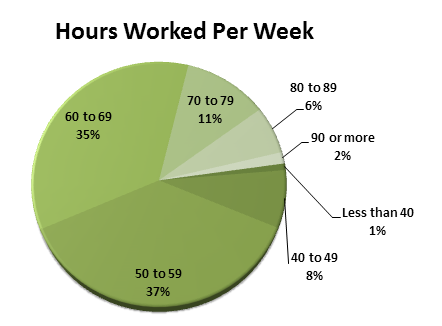

The finance industry has long been known for working employees, especially junior ones, to the extreme, often demanding upwards of 70 or 80 hours a week. However, recent controversies, including the death of a Bank of America intern after working three consecutive days with no sleep, along with a shift in the broader professional world to more work life balance are beginning to change the industry.

In the 2014 Private Equity and Venture Capital Compensation Report, there was a significant decline in the correlation between the number of hours spent in the office, and the total compensation of the employee. While the lowest pay was found among those putting in less than 40 hours per week, perhaps reflecting part-time employees, the highest pay was not found among those working the most hours, over 90 per week. In fact, there was a considerable drop off in compensation for employees working beyond 70 hours a week.

In the 2014 Private Equity and Venture Capital Compensation Report, there was a significant decline in the correlation between the number of hours spent in the office, and the total compensation of the employee. While the lowest pay was found among those putting in less than 40 hours per week, perhaps reflecting part-time employees, the highest pay was not found among those working the most hours, over 90 per week. In fact, there was a considerable drop off in compensation for employees working beyond 70 hours a week.

With that considered, working in private equity is almost certainly going to require longer hours than a typical nine to five job. The majority of private equity and venture capital employees worked over 60 hours per week, with a full 54 percent responding they’re putting in such hours. On top of that, an additional 37 percent of respondents indicated they are working between 50 and 59 hours per week. So with 97 percent of employees putting in more than 10 hours of “overtime” per week, those considering a move to the industry should not view recent developments to more balance as a significant decrease in workload.

When it came to vacation time, the report found very little change compared to last year, with the majority of firms offering between 3 and 4 weeks of vacation. A select few offered a generous 5 to 6 weeks, while some firms offered only 2 weeks or even no paid vacation. While 3.4 weeks may have been the average vacation entitlement, employees only took 2.7 weeks in actual leave.

While the industry may be shifting towards more balance, old attitudes remain and work expectations may differ greatly by firm. Some of the old guard in the industry still takes a view that more hours demonstrate greater commitment to the firm. Randall Dillard, managing director and chief investment officer at Liongate Capital Management, recently told a room full of future financial professionals at the 2014 London School of Economics Alternative Investments Conference that 60 hours a week is “not even in the game.”

So even if some of the larger institutions are beginning to take notice of the potential upside of adding more balance, it may be a long time before such views are held industry wide.

In the 2014 Private Equity and Venture Capital Compensation Report, there was a significant decline in the correlation between the number of hours spent in the office, and the total compensation of the employee. While the lowest pay was found among those putting in less than 40 hours per week, perhaps reflecting part-time employees, the highest pay was not found among those working the most hours, over 90 per week. In fact, there was a considerable drop off in compensation for employees working beyond 70 hours a week.

In the 2014 Private Equity and Venture Capital Compensation Report, there was a significant decline in the correlation between the number of hours spent in the office, and the total compensation of the employee. While the lowest pay was found among those putting in less than 40 hours per week, perhaps reflecting part-time employees, the highest pay was not found among those working the most hours, over 90 per week. In fact, there was a considerable drop off in compensation for employees working beyond 70 hours a week.