Apr 9, 2014 | Bonuses

When it comes to compensation in the private equity and venture capital industries, bonuses are a key component of one’s pay package, with some professionals earning more than half their compensation through incentive pay. Linked to fund performance, bonuses can often be at times volatile, though in recent years payouts have been relatively healthy. Last year, with robust equity markets and return to more active deal making, private equity firms posted excellent returns for their investors, driving bonuses higher.

One key marker of industry performance, the LPX 50 index which tracks some of the top private equity companies that are publically listed, reflects this strong performance with a near 40 percent return in the past year. When asked to explain the source of these remarkable returns, Sam Armstrong of Barwon Private Equity told Fundweb, “anecdotally it appears to be a range of things: low interest rates and low funding costs, strong earnings margins and more aggressive cost management.”

Armstrong also pointed to flexibility being key for private equity firms, referring to their ability change focus quickly in rapidly evolving markets.

The strong performance posted by the LPX 50 mirrors the sentiment captured by the 2014 Private Equity and Venture Capital Compensation Report. In terms of 2013 fund performance, nearly 19 percent of respondents indicated that they expected their funds to provide returns in excess of 25 percent this past year. A further 47 percent expected returns between 10 and 25 percent, indicating that two thirds of respondents expected double digit returns for 2013. In a time of low fixed income yields, this kind of performance sets up private equity and venture capital well as an alternative asset class, providing diversification for portfolio managers.

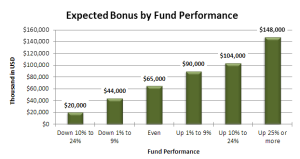

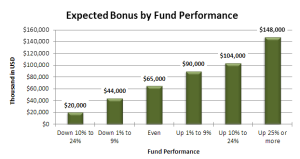

Fortunately for employees of private equity firms, this high level of performance is resulting in lucrative payouts when it comes to bonuses. According to the compensation report, for firms with 25 percent or higher performance in 2013, employees expected a bonus of $148,000 on average. Bonuses for firms reporting gains in the 10-24 percent range averaged $104,000. While the average is likely weighted higher by the remarkable payouts seen by senior management, even the more junior members of these firms likely enjoyed a large bonus this year.

Fortunately for employees of private equity firms, this high level of performance is resulting in lucrative payouts when it comes to bonuses. According to the compensation report, for firms with 25 percent or higher performance in 2013, employees expected a bonus of $148,000 on average. Bonuses for firms reporting gains in the 10-24 percent range averaged $104,000. While the average is likely weighted higher by the remarkable payouts seen by senior management, even the more junior members of these firms likely enjoyed a large bonus this year.

Throughout the full range of performance, from funds that were down on the year to the highest performers, a clear correlation existed between investor returns and bonus payouts. This has become more apparent through the years as investors demand tighter linkages between their own returns and the compensation of their money managers. It also makes sense from a fund perspective, where high bonus payouts can be more easily managed after a year of strong performance and likely net inflows, compared to a year where revenue is scarcer.

As professionals look back on 2013, they’ll remember a year of strong performance and year of high personal compensation. And the next year is looking to be promising as well, with optimism high and a strong start to 2014. With that optimism, private equity and venture capital employees are likely looking forward to another year of strong bonuses as the closer ties between performance and compensation pay off.

Mar 18, 2014 | Industry

Coming off several consecutive years of compensation growth, the private equity and venture capital industry is poised for continued prosperity, both for firms and for employees. Following strong earnings growth in 2012 and 2011, salaries continued to climb in 2013, posting remarkable gains. Even more encouraging, most employees in the industry expect the trend to continue in 2014, as increased investor demand drives the industry forward.

According to the Wall Street Journal, institutional investors are coming back to the private equity industry in a great wave, with nearly $217 billion in new funds for 2013 in the U.S. alone. This represents a 15 percent increase over 2012 fundraising levels, led primarily by buyout firms but also with great support from distressed debt and turnaround funds.

According to the Wall Street Journal, institutional investors are coming back to the private equity industry in a great wave, with nearly $217 billion in new funds for 2013 in the U.S. alone. This represents a 15 percent increase over 2012 fundraising levels, led primarily by buyout firms but also with great support from distressed debt and turnaround funds.

While equity markets posted strong returns in 2013, the lack of attractive returns through diversification in debt markets is perhaps one cause for the shift towards private equity. Many portfolio managers and large investors seeking higher returns from asset classes with less correlation with broader equity markets are taking a long look at private equity.

And fortunately for employees of private equity firms, the success of the industry is resulting in larger personal bank accounts as well, according to the 2014 Private Equity and Venture Capital Compensation Report. The vast majority of industry professionals had expected their 2013 earnings to exceed their 2012 pay, with 62 percent reporting an expected increase in their 2013 take home pay. In some cases, this increase was substantial, with a full 31 percent of respondents expecting an increase over 16 percent. On the flip side, only 5 percent of respondents expected to take home less in 2013, dropping from 8 percent in the prior year.

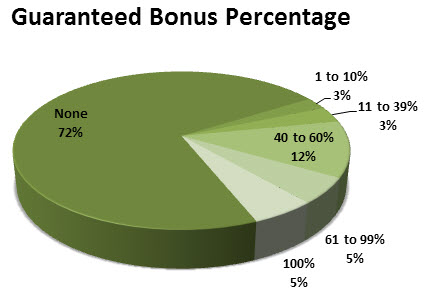

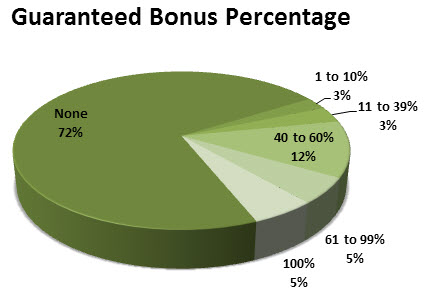

Even in an industry known for large bonus payouts, increasingly private equity compensation is coming in the form of bonuses. Over 39 percent of total compensation in 2013 came from incentives, up from 36 percent in the prior year. This reflects a growing trend in the broader financial industry towards more closely linking compensation with fund performance.

As the industry continues to raise funds at an ever more frantic pace, the opportunity for continued compensation growth will remain. Continued record low interest rates will provide a catalyst for further transfers into the alternative asset segment, and private equity is well position to be a leader in taking up that demand, particularly from institutional clients. Along with the rapid growth in assets under management will come a similar pace of growth in private equity salaries. Accordingly, the future outlook remains bright for professionals in the private equity industry.

Feb 25, 2014 | Culture

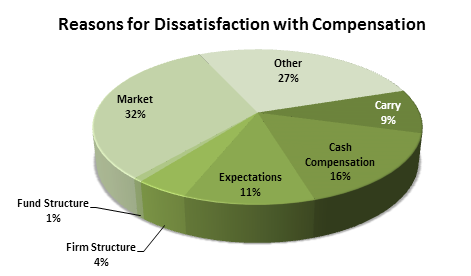

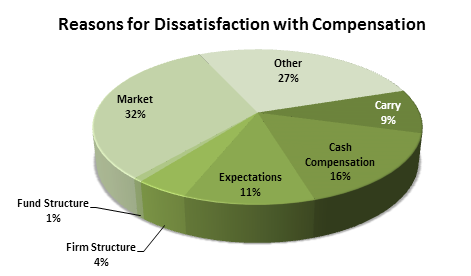

Without a doubt, the private equity and venture capital industries are the source of some of the largest compensation packages in any business worldwide. However, professionals in the industry constantly compare their pay to those in related industries where their skills could be put to use for perhaps higher salaries and bonuses. As a result, monitoring satisfaction with pay for private equity and venture capital professionals is an important activity for managers in the industry concerned with retaining their top talents.

Unfortunately for those managers, the 2014 Private Equity and Venture Capital report found there was a notable decline in pay satisfaction in comparison to last year’s survey. Only 46 percent of employees found themselves satisfied with their pay this year, in comparison to 56 percent of employees in the prior year. This year’s result is still favorable compared to the 41 and 36 percent satisfaction levels noted in the 2012 and 2011 reports respectively, however a shift in the trend will certainly be something that managers will want to keep an eye on in the coming year.

Unfortunately for those managers, the 2014 Private Equity and Venture Capital report found there was a notable decline in pay satisfaction in comparison to last year’s survey. Only 46 percent of employees found themselves satisfied with their pay this year, in comparison to 56 percent of employees in the prior year. This year’s result is still favorable compared to the 41 and 36 percent satisfaction levels noted in the 2012 and 2011 reports respectively, however a shift in the trend will certainly be something that managers will want to keep an eye on in the coming year.

Taking a holistic view on employee satisfaction in the workplace may be one step towards increasing pay satisfaction – the solution isn’t always just increased compensation, but perhaps a more enjoyable workplace where employees don’t just look to cash for satisfaction. This might sound like an attitude more prevalent in a west coast tech start-up, but even Wall Street is starting to take notice, finding that spending a little on Wellness can curb compensation demands.

According to a recent CNN Money report even firms like Goldman Sachs are exploring new ways to motivate employees, whether it be a tai chi club or meditation sessions. While this may be primarily aimed at recruiting and attracting young employees that may be more interested in lifestyle than dollars, the trickle down impacts on the broader employee base can be tangible in lower turnover and less burnout. While there isn’t a great deal of disclosure from private equity firms on innovative wellness initiatives, staying competitive in the overall financial job market will be important going forward.

In many cases, these benefits aren’t about having employees spend less time at the office to find balance, but rather bring many of the employees interests to them in a more convenient package so they can explore their interests in conjunction with the long hours that are often expected in finance jobs. Whether private equity managers explore such initiatives in order to reign in declining pay satisfaction remains to be seen, but these options certainly should be considered as a potential low cost way to build employee enjoyment of their workplace.

Feb 4, 2014 | Bonuses, private equity compensation

The annual bonus is a large part of compensation in the financial industry and this holds true in both private equity and venture capital firms. Depending on a number of factors, bonuses can range from a most welcome “extra paycheck” at the end of the year to a substantial majority of a professional’s total compensation. Our 2013 Private Equity and Venture Capital Compensation Report identified several factors that influence bonuses in the industry, from fund performance to firm size and job titles. Considering all of these elements is critical when attempting to determine whether a bonus is on market or not.

One of the obvious factors that drive bonus levels in the industry is fund performance. Simply put, a firm experiencing greater success is likely to reward its employees most handsomely. This was certainly one of the leading factors in the differences between reported bonus levels. Top performing funds, earning in excess of 25 percent for their investors, rewarded employees with $151 thousand in incentives in 2012. That compares to only $11,000 being awarded to employees in firms that lost over 10 percent of their value. With a clear trend correlated with performance, it’s safe to assume that the majority of a private equity professional’s bonus will be driven by the returns the fund provides to its investors.

Another factor that weighs on the size of one’s bonus is firm size. While performance can also be somewhat correlated with firm size in some cases, it still holds that both the number of employees and the size of the firm or fund weighs heavily in how much bonus compensation an employee will receive. In general, firms that manage more assets tend to offer higher bonuses despite base compensation being largely the same between firms. On average, an employee at a firm managing $1 billion or more in assets earned a bonus of $250 thousand in 2012, while at a firm with under $200 million in assets an employee would be likely to see $100 thousand in incentive pay.

Somewhat surprising, however, is the impact of the number of firm employees on expected bonus size. The highest bonuses were seen among firms with less than 5 employees. This likely reflects the concentration of senior professionals in smaller firms and a higher reliance on results in order to sustain the very existence of the firm.

The rewarding of senior employees through higher bonus payouts was seen across the industry however, not just in small firms. For example, the average bonus of a Director was around between $100 and $130 thousand per year across all firm sizes, while an associate saw between $24 and $66 thousand. The largest bonus payouts were found in those with Partner and Managing Partner titles, with some big firm leaders earning up to $1.5 million in incentive pay in 2012. Across job titles, a clear trend is evident in that more senior employees will find a larger portion of their pay coming from incentives. This trend likely ties in to their greater influence on firm profits.

With this considered, it’s important to keep in mind all of these factors when evaluating incentive compensation. Bonuses can vary heavily based on these factors. However, performance is always the key driving factor in incentive payouts, whether that’s the performance of the fund or an individual’s own contribution. Successful results are always the best way to ensure a higher bonus payment at the end of the year.

Jan 6, 2014 | Firms

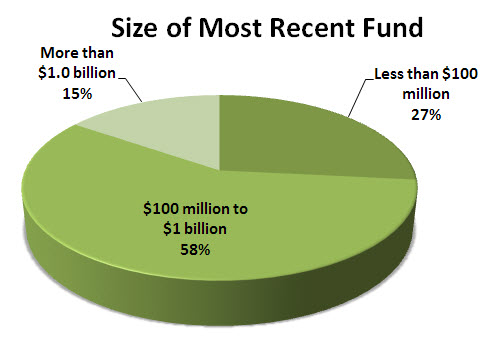

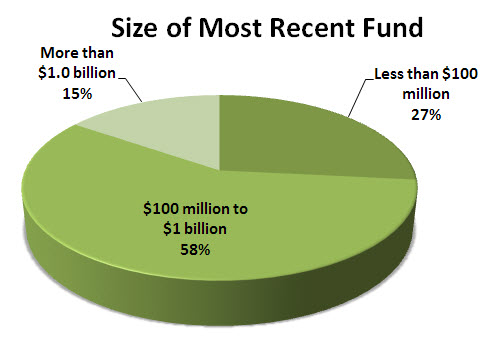

One of the key determining factors in private equity compensation is the size of the fund the professional is working for. Far from a new trend, we have seen this reinforced in numerous surveys dating back several years. However, the differences in compensation practices between funds of varying sizes are more complex than they appear on the surface, and the underlying complexities may be important to those negotiating compensation in the industry.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

However, one complexity is the difference between the size of the firm a professional works for, and the size of the most recent fund offering that firm has launched. We noted less of a differential between firm size than between most recent fund size, which could be a valuable piece of information for job seekers and recruiters alike. So while the gap between large firms and small firms was about $250 thousand in 2012, the gap between those working for a firm that recent launched a large fund and a small fund was only $200 thousand. This 20 percent differential between fund size and firm size may be key to negotiating higher salary when approaching firms that have launched large funds relative to their size.

Of course, compensation depends heavily on title and here we saw discrepancy between fund sizes as well. As a firm grows, not all positions within the firm seem to benefit from the overall higher trend in total compensation. Those at the higher levels of a firm seem to benefit most from the overall growth in compensation. Principals saw the highest differential, well over 100 percent, in total compensation between small firms and large firms. This is likely due to higher incentive pay amongst senior leaders due to the successful growth of the firm. On the other hand, analysts saw very little difference in compensation between small and large firms, earning only about 25 percent more at large funds.

As we can see, while on the surface it seems simple to suggest that those working for large firms earn more than their small shop counterparts, complexities certainly make the comparison more difficult. Differences in recently launched fund sizes and in position within the organization cloud the overall picture. In order to accurately negotiate compensation, such details need to be factored in by human resources professionals and job seekers alike.

Fortunately for employees of private equity firms, this high level of performance is resulting in lucrative payouts when it comes to bonuses. According to the compensation report, for firms with 25 percent or higher performance in 2013, employees expected a bonus of $148,000 on average. Bonuses for firms reporting gains in the 10-24 percent range averaged $104,000. While the average is likely weighted higher by the remarkable payouts seen by senior management, even the more junior members of these firms likely enjoyed a large bonus this year.

Fortunately for employees of private equity firms, this high level of performance is resulting in lucrative payouts when it comes to bonuses. According to the compensation report, for firms with 25 percent or higher performance in 2013, employees expected a bonus of $148,000 on average. Bonuses for firms reporting gains in the 10-24 percent range averaged $104,000. While the average is likely weighted higher by the remarkable payouts seen by senior management, even the more junior members of these firms likely enjoyed a large bonus this year.

According to the

According to the  Unfortunately for those managers, the 2014 Private Equity and Venture Capital report found there was a notable decline in pay satisfaction in comparison to last year’s survey. Only 46 percent of employees found themselves satisfied with their pay this year, in comparison to 56 percent of employees in the prior year. This year’s result is still favorable compared to the 41 and 36 percent satisfaction levels noted in the 2012 and 2011 reports respectively, however a shift in the trend will certainly be something that managers will want to keep an eye on in the coming year.

Unfortunately for those managers, the 2014 Private Equity and Venture Capital report found there was a notable decline in pay satisfaction in comparison to last year’s survey. Only 46 percent of employees found themselves satisfied with their pay this year, in comparison to 56 percent of employees in the prior year. This year’s result is still favorable compared to the 41 and 36 percent satisfaction levels noted in the 2012 and 2011 reports respectively, however a shift in the trend will certainly be something that managers will want to keep an eye on in the coming year.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.