Jan 6, 2014 | Firms

One of the key determining factors in private equity compensation is the size of the fund the professional is working for. Far from a new trend, we have seen this reinforced in numerous surveys dating back several years. However, the differences in compensation practices between funds of varying sizes are more complex than they appear on the surface, and the underlying complexities may be important to those negotiating compensation in the industry.

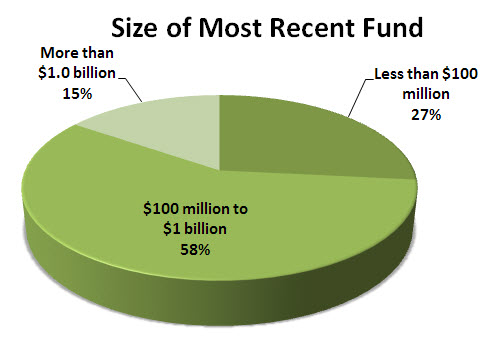

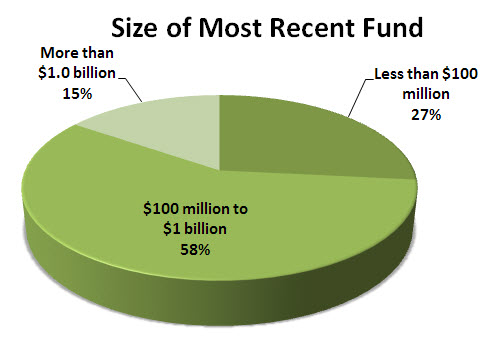

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

However, one complexity is the difference between the size of the firm a professional works for, and the size of the most recent fund offering that firm has launched. We noted less of a differential between firm size than between most recent fund size, which could be a valuable piece of information for job seekers and recruiters alike. So while the gap between large firms and small firms was about $250 thousand in 2012, the gap between those working for a firm that recent launched a large fund and a small fund was only $200 thousand. This 20 percent differential between fund size and firm size may be key to negotiating higher salary when approaching firms that have launched large funds relative to their size.

Of course, compensation depends heavily on title and here we saw discrepancy between fund sizes as well. As a firm grows, not all positions within the firm seem to benefit from the overall higher trend in total compensation. Those at the higher levels of a firm seem to benefit most from the overall growth in compensation. Principals saw the highest differential, well over 100 percent, in total compensation between small firms and large firms. This is likely due to higher incentive pay amongst senior leaders due to the successful growth of the firm. On the other hand, analysts saw very little difference in compensation between small and large firms, earning only about 25 percent more at large funds.

As we can see, while on the surface it seems simple to suggest that those working for large firms earn more than their small shop counterparts, complexities certainly make the comparison more difficult. Differences in recently launched fund sizes and in position within the organization cloud the overall picture. In order to accurately negotiate compensation, such details need to be factored in by human resources professionals and job seekers alike.

May 13, 2013 | MBA

There are a number of interesting correlations between education in private equity and venture capital compensation. In our report, we primarily looked at the value that an MBA brings to those in the industry, and whether they experience increased earnings compared to their peers. While we found some interesting trends worth consideration, it’s important to note that this may not tell the whole story when it comes to the value of an MBA in the private equity and venture capital industries.

In 2012 we did note that those with an MBA do on average earn more than their lesser educated peers. In fact, when it came to base salaries, those with the advanced degree earned approximately 12 percent more than peers without the degree. Vacation entitlements, generally three and a half weeks, were largely the same regardless of education level, which likely reflects standardization at most firms.

This doesn’t mean, however, that an MBA is a worthwhile investment for all of those looking to undertake the program in order to get a leg up in the private equity industry. There is a substantial cost to pursuing an MBA. The top tier schools that provide the highest boosts in annual earnings aren’t cheap, and a degree can run an individual over $200,000 when all costs are factored in. When discounting the small advantage in higher salary received by MBAs over their career, serious doubts exist about whether the degree pays for itself.

Further, we found that when it came to bonus payouts, education wasn’t such an advantage. In fact, those with MBAs generally earned a smaller bonus, albeit higher total compensation, than their peers. This relates back to the structure of bonuses being driven primarily by tangible results either individually or as a firm. While an MBA can certainly add value, there is no guarantee that will translate into improvements in any given metric a firm uses to tabulate bonus pay. And as a result of these lower bonuses, the total compensation advantage for those with an MBA was only about 4 percent last year.

That said, some of the value of an MBA can’t be measured in dollars. Those with the degree have vast networks established while in these programs, providing them access to more opportunities than those without time spent in the halls of the elite business schools. For some, this could mean the difference between employment and unemployment during tough times. As a result, there are a large number of individuals that still see a great deal of value in the degree, and we certainly wouldn’t disagree.

Apr 29, 2013 | Performance

While cash compensation is certainly front of mind for most individuals working in the private equity and venture capital industry, training can also be an important piece of overall compensation with significant advantages for both individuals and their firms. With advantages to the firm including increased productivity, increasing firm skill and “bench strength,” and higher retention, its easy to see why funds are looking at options for providing increased training opportunities to their teams. And the team members are appreciating the training as well, with indicators of higher job satisfaction and loyalty.

Many private equity and venture capital firms are smaller in size and struggle justifying the sometimes considerable cash cost of training, especially in a market increasingly moving to a lower fee model. However, these are also firms most well positioned to take advantage of training opportunities. In many of these firms, one or two specialists tends to look after certain firm responsibilities, creating issues when these people choose to depart or become overwhelmed. The firm then needs to desperate seek out a replacement or support, which of course is costly and doesn’t always result in a good fit within the team. Providing training to existing team members to ensure bench strength exists and employees are able to cover for each other, at least in the short term, can provide significant value.

While all employees tend to enjoy the opportunity of expanding their knowledge, young employees who are early in their careers, often stand to gain the most from training and also tend to put greater emphasis on this benefit. In fact, attracting young employees out of school or those with only a few years of industry experience may be easier with a strong reputation as a firm who will help employees build their knowledge. Providing training to young employees will also enable them to see a clear path for advancement within the firm, creating loyalty and also potentially lower recruiting costs for higher positions by promoting from within.

Many firms also worry that training their employees will lead them to seek opportunities elsewhere, losing the value of their investment in training costs and time. This is a valid concern and certainly a number of employees will leave after undergoing training. However, even more employees tend to view the investment by the firm in their skills to be an indicator of loyalty, encouraging them to stay on and seeking potential advancement.

Private equity and venture capital firms certainly do stand to benefit greatly by increasing training programs, especially in areas where it can expand the firm’s internal skill set. As a result, expect to see more teams look to training as a key component of their development plans, while more employees will come to demand training as a core component of their overall compensation.

Apr 15, 2013 | Culture

In light of a more optimistic economic outlook, private equity and venture capital firms are increasingly looking at hiring to fill their ranks. As the job market becomes increasingly competitive, these firms have to become more creative in order to ensure they attract the most talented individuals. While a large compensation package and the prestige of working for top firms will appeal to many job seekers, firms are looking to expand their offerings beyond the traditional lures and are now addressing work life balance in order to attract and retain top talent.

One trend we’ve seen over the past couple of decades is the increasing importance that individuals put on work life balance. In the past, many workers focused solely on earnings potential, but younger generations are not so quick to trade their time for higher pay. In order to address this shift in preferences, firms are looking at ways to offer more flexible schedules and work arrangements, reduce time spent in the office while considering providing more vacation time.

These types of changes reflect a focus on attracting and retaining young workers, individuals that may have obligations raising a young family or taking care of aging relatives. Firms that chose to be more flexible in dealing with employees are at a marked advantage in attracting and retaining those from this high prized demographic group.

While we are seeing improvements, the financial industry has been a slow adopter of work life balance measures in comparison to the overall corporate world in the United States. Some of this is due to simple realities of the business; rigid trading hours still exist and for many positions, people need to be on the desk for a certain amount of time per day. For non-trading positions, however, much of the lack of progress in shifting to a more balanced employment model is cultural. In most firms, working long hours is a badge of honor and more senior employees and managers view time at the desk as a critical measure for advancement.

While this culture of long hours may still exist at most firms, the reality is that in an environment where fee revenue is harder and harder to come by, firms must look at work life balance as a part of an overall compensation package in order to reduce or limit cash costs. As a result, and following an overall trend amongst U.S. companies, we can expect greater focus on this core benefit in the coming years.

Apr 1, 2013 | Industry

The outlook for employment in the private equity and venture capital industry is quite bullish for the coming year according the results of our 2013 compensation report. As the industry ramps up in the wake of stronger economic fundaments around the world, firms are increasingly looking at adding new talent to their ranks, essentially showing increased hiring intentions in all disciplines. Whether one is looking to enter the industry for the first time, or perhaps move to a new firm for different opportunities, 2013 is shaping up to be a good year to execute on those plans.

Overall, we found a considerable increase in hiring intentions in both private equity and venture capital firms for the coming year. According to our respondents, 59 percent of firms will be looking at add new investment professionals and support staff this year. This is up sharply from only 37 percent last year. This reflects the strength of both private equity and venture capital as the global economy finally begins to sputter forward.

It is also important to note that this remarkably strong level of hiring intentions is not to be found throughout the financial industry, where many segments, such as investment banking for example, continue to struggle for grow their revenues in order to support the addition of new staff. Private equity and venture capital continue to offer a relative haven within the over industry, providing opportunity for many financial professionals that are struggling to gain traction in other segments that are on the decline.

Hiring intentions weren’t the only positive development that our survey picked up this year. We also found a considerable reduction in firms that are looking to reduce headcount this year, with only 2 percent of firms are looking to employ fewer financial professionals in 2013. This is an important trend as employees in the industry are concerned about firms increasingly seeking efficiencies and implementing technological solutions that could allow the firm to operate with a smaller staff. These results imply that any gains in efficiency are quickly being offset by business growth.

The strength of hiring intentions depends on which skillset an employee is bringing to the firm. The most in demand skillset, unsurprisingly, is investment professionals. Also in demand are accounting, operations and portfolio management professionals. According to our survey, firms are looking less often in 2013 for those with skills in IT and investor relations.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.