Feb 19, 2015 | Performance

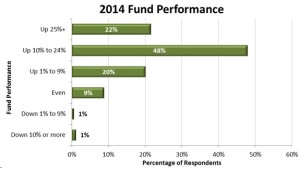

After a year of strong performance in the sector, private equity and venture capital professionals posted some remarkable pay gains in 2014. While the S&P 500 posted a fairly strong total return of 14 percent in 2014, the majority of our respondents indicated their funds were likely to beat these equity benchmarks for the year.

Investors looking for diversification along with higher returns compared to other possible alternative asset classes are increasingly looking to private equity as a solution. According to Preqin, 57 percent of private equity firms said they saw increased investor appetite over the last year, while only 12 percent of firms said they saw reduced interest. In an industry where management fees, based on assets under management, drive the bottom line for firms, the increased amount of capital available is one factor in driving up compensation in the industry. Sustained interest in the segment will continue to allow for improved compensation among top performing firms.

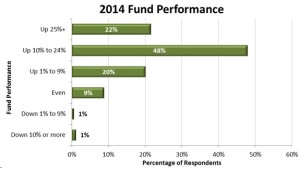

Behind all of this investor interest and new money, of course, is performance. Our survey respondents at private equity and venture capital funds indicated their funds were expected to post stronger returns in 2014 than they did the prior year. At the upper end of the spectrum, 22 percent of respondents indicated their 2014 performance would exceed 25 percent, up 6 percentage points from the prior year. This strong performance is one factor driving compensation higher this year. And in light of increasing volatility in equity markets, the relative stability of private equity returns will be attractive to investors in the coming year.

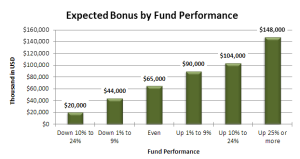

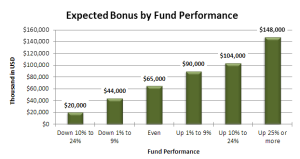

There is also a correlation between fund performance and bonuses, which comprise a large portion of the total compensation for all finance industry professionals. Our survey results indicated that the strongest performing funds also awarded the largest bonuses to their professionals, as expected. With the highest paid professionals earning sometimes the majority of their compensation through bonuses, fund performance can clearly have a large influence on total compensation payouts.

The coming year looks to be promising for private equity and venture capital firms, and their employees, if performance can be maintained at or near these levels. Increasing equity market volatility will encourage more investors to consider the more stable and long term focused returns consistent with private equity strategies. Firms successful in capturing this investor interest by building their assets under management will likely be the leaders in increasing compensation available to their employees, in order to attract and retain top talent.

May 20, 2014 | Culture

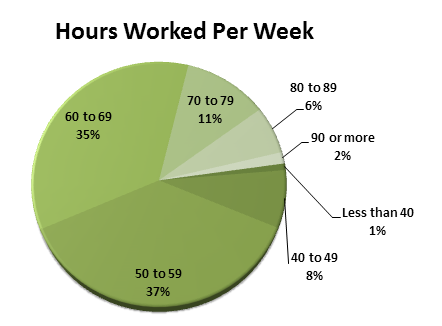

The finance industry has long been known for working employees, especially junior ones, to the extreme, often demanding upwards of 70 or 80 hours a week. However, recent controversies, including the death of a Bank of America intern after working three consecutive days with no sleep, along with a shift in the broader professional world to more work life balance are beginning to change the industry.

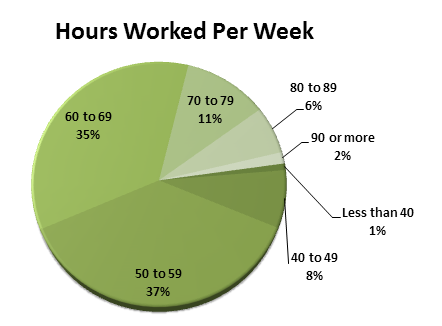

In the 2014 Private Equity and Venture Capital Compensation Report, there was a significant decline in the correlation between the number of hours spent in the office, and the total compensation of the employee. While the lowest pay was found among those putting in less than 40 hours per week, perhaps reflecting part-time employees, the highest pay was not found among those working the most hours, over 90 per week. In fact, there was a considerable drop off in compensation for employees working beyond 70 hours a week.

In the 2014 Private Equity and Venture Capital Compensation Report, there was a significant decline in the correlation between the number of hours spent in the office, and the total compensation of the employee. While the lowest pay was found among those putting in less than 40 hours per week, perhaps reflecting part-time employees, the highest pay was not found among those working the most hours, over 90 per week. In fact, there was a considerable drop off in compensation for employees working beyond 70 hours a week.

With that considered, working in private equity is almost certainly going to require longer hours than a typical nine to five job. The majority of private equity and venture capital employees worked over 60 hours per week, with a full 54 percent responding they’re putting in such hours. On top of that, an additional 37 percent of respondents indicated they are working between 50 and 59 hours per week. So with 97 percent of employees putting in more than 10 hours of “overtime” per week, those considering a move to the industry should not view recent developments to more balance as a significant decrease in workload.

When it came to vacation time, the report found very little change compared to last year, with the majority of firms offering between 3 and 4 weeks of vacation. A select few offered a generous 5 to 6 weeks, while some firms offered only 2 weeks or even no paid vacation. While 3.4 weeks may have been the average vacation entitlement, employees only took 2.7 weeks in actual leave.

While the industry may be shifting towards more balance, old attitudes remain and work expectations may differ greatly by firm. Some of the old guard in the industry still takes a view that more hours demonstrate greater commitment to the firm. Randall Dillard, managing director and chief investment officer at Liongate Capital Management, recently told a room full of future financial professionals at the 2014 London School of Economics Alternative Investments Conference that 60 hours a week is “not even in the game.”

So even if some of the larger institutions are beginning to take notice of the potential upside of adding more balance, it may be a long time before such views are held industry wide.

Apr 9, 2014 | Bonuses

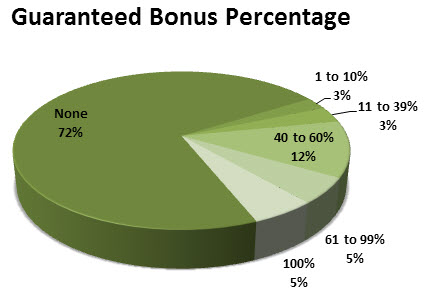

When it comes to compensation in the private equity and venture capital industries, bonuses are a key component of one’s pay package, with some professionals earning more than half their compensation through incentive pay. Linked to fund performance, bonuses can often be at times volatile, though in recent years payouts have been relatively healthy. Last year, with robust equity markets and return to more active deal making, private equity firms posted excellent returns for their investors, driving bonuses higher.

One key marker of industry performance, the LPX 50 index which tracks some of the top private equity companies that are publically listed, reflects this strong performance with a near 40 percent return in the past year. When asked to explain the source of these remarkable returns, Sam Armstrong of Barwon Private Equity told Fundweb, “anecdotally it appears to be a range of things: low interest rates and low funding costs, strong earnings margins and more aggressive cost management.”

Armstrong also pointed to flexibility being key for private equity firms, referring to their ability change focus quickly in rapidly evolving markets.

The strong performance posted by the LPX 50 mirrors the sentiment captured by the 2014 Private Equity and Venture Capital Compensation Report. In terms of 2013 fund performance, nearly 19 percent of respondents indicated that they expected their funds to provide returns in excess of 25 percent this past year. A further 47 percent expected returns between 10 and 25 percent, indicating that two thirds of respondents expected double digit returns for 2013. In a time of low fixed income yields, this kind of performance sets up private equity and venture capital well as an alternative asset class, providing diversification for portfolio managers.

Fortunately for employees of private equity firms, this high level of performance is resulting in lucrative payouts when it comes to bonuses. According to the compensation report, for firms with 25 percent or higher performance in 2013, employees expected a bonus of $148,000 on average. Bonuses for firms reporting gains in the 10-24 percent range averaged $104,000. While the average is likely weighted higher by the remarkable payouts seen by senior management, even the more junior members of these firms likely enjoyed a large bonus this year.

Fortunately for employees of private equity firms, this high level of performance is resulting in lucrative payouts when it comes to bonuses. According to the compensation report, for firms with 25 percent or higher performance in 2013, employees expected a bonus of $148,000 on average. Bonuses for firms reporting gains in the 10-24 percent range averaged $104,000. While the average is likely weighted higher by the remarkable payouts seen by senior management, even the more junior members of these firms likely enjoyed a large bonus this year.

Throughout the full range of performance, from funds that were down on the year to the highest performers, a clear correlation existed between investor returns and bonus payouts. This has become more apparent through the years as investors demand tighter linkages between their own returns and the compensation of their money managers. It also makes sense from a fund perspective, where high bonus payouts can be more easily managed after a year of strong performance and likely net inflows, compared to a year where revenue is scarcer.

As professionals look back on 2013, they’ll remember a year of strong performance and year of high personal compensation. And the next year is looking to be promising as well, with optimism high and a strong start to 2014. With that optimism, private equity and venture capital employees are likely looking forward to another year of strong bonuses as the closer ties between performance and compensation pay off.

Mar 18, 2014 | Industry

Coming off several consecutive years of compensation growth, the private equity and venture capital industry is poised for continued prosperity, both for firms and for employees. Following strong earnings growth in 2012 and 2011, salaries continued to climb in 2013, posting remarkable gains. Even more encouraging, most employees in the industry expect the trend to continue in 2014, as increased investor demand drives the industry forward.

According to the Wall Street Journal, institutional investors are coming back to the private equity industry in a great wave, with nearly $217 billion in new funds for 2013 in the U.S. alone. This represents a 15 percent increase over 2012 fundraising levels, led primarily by buyout firms but also with great support from distressed debt and turnaround funds.

According to the Wall Street Journal, institutional investors are coming back to the private equity industry in a great wave, with nearly $217 billion in new funds for 2013 in the U.S. alone. This represents a 15 percent increase over 2012 fundraising levels, led primarily by buyout firms but also with great support from distressed debt and turnaround funds.

While equity markets posted strong returns in 2013, the lack of attractive returns through diversification in debt markets is perhaps one cause for the shift towards private equity. Many portfolio managers and large investors seeking higher returns from asset classes with less correlation with broader equity markets are taking a long look at private equity.

And fortunately for employees of private equity firms, the success of the industry is resulting in larger personal bank accounts as well, according to the 2014 Private Equity and Venture Capital Compensation Report. The vast majority of industry professionals had expected their 2013 earnings to exceed their 2012 pay, with 62 percent reporting an expected increase in their 2013 take home pay. In some cases, this increase was substantial, with a full 31 percent of respondents expecting an increase over 16 percent. On the flip side, only 5 percent of respondents expected to take home less in 2013, dropping from 8 percent in the prior year.

Even in an industry known for large bonus payouts, increasingly private equity compensation is coming in the form of bonuses. Over 39 percent of total compensation in 2013 came from incentives, up from 36 percent in the prior year. This reflects a growing trend in the broader financial industry towards more closely linking compensation with fund performance.

As the industry continues to raise funds at an ever more frantic pace, the opportunity for continued compensation growth will remain. Continued record low interest rates will provide a catalyst for further transfers into the alternative asset segment, and private equity is well position to be a leader in taking up that demand, particularly from institutional clients. Along with the rapid growth in assets under management will come a similar pace of growth in private equity salaries. Accordingly, the future outlook remains bright for professionals in the private equity industry.

Feb 25, 2014 | Culture

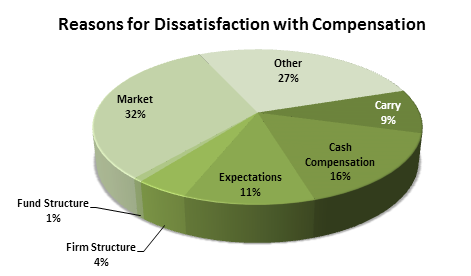

Without a doubt, the private equity and venture capital industries are the source of some of the largest compensation packages in any business worldwide. However, professionals in the industry constantly compare their pay to those in related industries where their skills could be put to use for perhaps higher salaries and bonuses. As a result, monitoring satisfaction with pay for private equity and venture capital professionals is an important activity for managers in the industry concerned with retaining their top talents.

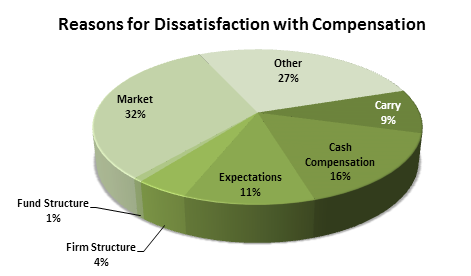

Unfortunately for those managers, the 2014 Private Equity and Venture Capital report found there was a notable decline in pay satisfaction in comparison to last year’s survey. Only 46 percent of employees found themselves satisfied with their pay this year, in comparison to 56 percent of employees in the prior year. This year’s result is still favorable compared to the 41 and 36 percent satisfaction levels noted in the 2012 and 2011 reports respectively, however a shift in the trend will certainly be something that managers will want to keep an eye on in the coming year.

Unfortunately for those managers, the 2014 Private Equity and Venture Capital report found there was a notable decline in pay satisfaction in comparison to last year’s survey. Only 46 percent of employees found themselves satisfied with their pay this year, in comparison to 56 percent of employees in the prior year. This year’s result is still favorable compared to the 41 and 36 percent satisfaction levels noted in the 2012 and 2011 reports respectively, however a shift in the trend will certainly be something that managers will want to keep an eye on in the coming year.

Taking a holistic view on employee satisfaction in the workplace may be one step towards increasing pay satisfaction – the solution isn’t always just increased compensation, but perhaps a more enjoyable workplace where employees don’t just look to cash for satisfaction. This might sound like an attitude more prevalent in a west coast tech start-up, but even Wall Street is starting to take notice, finding that spending a little on Wellness can curb compensation demands.

According to a recent CNN Money report even firms like Goldman Sachs are exploring new ways to motivate employees, whether it be a tai chi club or meditation sessions. While this may be primarily aimed at recruiting and attracting young employees that may be more interested in lifestyle than dollars, the trickle down impacts on the broader employee base can be tangible in lower turnover and less burnout. While there isn’t a great deal of disclosure from private equity firms on innovative wellness initiatives, staying competitive in the overall financial job market will be important going forward.

In many cases, these benefits aren’t about having employees spend less time at the office to find balance, but rather bring many of the employees interests to them in a more convenient package so they can explore their interests in conjunction with the long hours that are often expected in finance jobs. Whether private equity managers explore such initiatives in order to reign in declining pay satisfaction remains to be seen, but these options certainly should be considered as a potential low cost way to build employee enjoyment of their workplace.

Feb 4, 2014 | Bonuses, private equity compensation

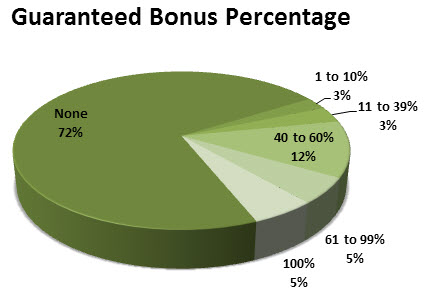

The annual bonus is a large part of compensation in the financial industry and this holds true in both private equity and venture capital firms. Depending on a number of factors, bonuses can range from a most welcome “extra paycheck” at the end of the year to a substantial majority of a professional’s total compensation. Our 2013 Private Equity and Venture Capital Compensation Report identified several factors that influence bonuses in the industry, from fund performance to firm size and job titles. Considering all of these elements is critical when attempting to determine whether a bonus is on market or not.

One of the obvious factors that drive bonus levels in the industry is fund performance. Simply put, a firm experiencing greater success is likely to reward its employees most handsomely. This was certainly one of the leading factors in the differences between reported bonus levels. Top performing funds, earning in excess of 25 percent for their investors, rewarded employees with $151 thousand in incentives in 2012. That compares to only $11,000 being awarded to employees in firms that lost over 10 percent of their value. With a clear trend correlated with performance, it’s safe to assume that the majority of a private equity professional’s bonus will be driven by the returns the fund provides to its investors.

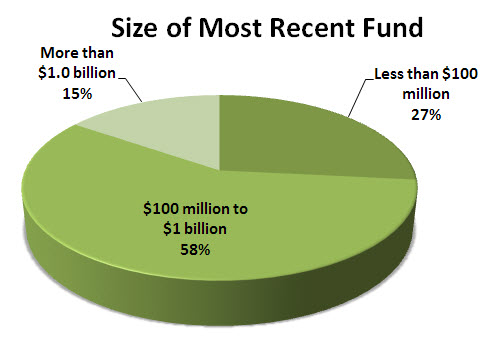

Another factor that weighs on the size of one’s bonus is firm size. While performance can also be somewhat correlated with firm size in some cases, it still holds that both the number of employees and the size of the firm or fund weighs heavily in how much bonus compensation an employee will receive. In general, firms that manage more assets tend to offer higher bonuses despite base compensation being largely the same between firms. On average, an employee at a firm managing $1 billion or more in assets earned a bonus of $250 thousand in 2012, while at a firm with under $200 million in assets an employee would be likely to see $100 thousand in incentive pay.

Somewhat surprising, however, is the impact of the number of firm employees on expected bonus size. The highest bonuses were seen among firms with less than 5 employees. This likely reflects the concentration of senior professionals in smaller firms and a higher reliance on results in order to sustain the very existence of the firm.

The rewarding of senior employees through higher bonus payouts was seen across the industry however, not just in small firms. For example, the average bonus of a Director was around between $100 and $130 thousand per year across all firm sizes, while an associate saw between $24 and $66 thousand. The largest bonus payouts were found in those with Partner and Managing Partner titles, with some big firm leaders earning up to $1.5 million in incentive pay in 2012. Across job titles, a clear trend is evident in that more senior employees will find a larger portion of their pay coming from incentives. This trend likely ties in to their greater influence on firm profits.

With this considered, it’s important to keep in mind all of these factors when evaluating incentive compensation. Bonuses can vary heavily based on these factors. However, performance is always the key driving factor in incentive payouts, whether that’s the performance of the fund or an individual’s own contribution. Successful results are always the best way to ensure a higher bonus payment at the end of the year.

Jan 14, 2014 | private equity compensation

The seventh annual Private Equity and Venture Capital Compensation Report, released by the consulting firm Benchmark Compensation, indicates compensation growth in the private equity and venture capital markets is slowing.

Although private equity professionals in certain roles reported increases in compensation this year, overall, the growth in cash compensation flattened from last year’s numbers. The average private equity professional worked more than 60 hours per week and earned $271,000 USD in cash compensation this year.

When it came to compensation changes by job title, some positions outperformed others, with Managing Partners, Principals, Directors and Investment Managers seeing some of the biggest increases. In the junior ranks of the firm, analysts, senior analysts, associates and senior associates all saw fairly modest gains.

When it came to compensation changes by job title, some positions outperformed others, with Managing Partners, Principals, Directors and Investment Managers seeing some of the biggest increases. In the junior ranks of the firm, analysts, senior analysts, associates and senior associates all saw fairly modest gains.

“We were closely watching cash compensation trends in 2013 because we anticipated that the carried interest tax break was in jeopardy,” said David Kochanek, Publisher of PrivateEquityCompensation.com. “It looks like carry will live to fight another day, so we don’t think we will see any major shifts in how private equity and venture capital compensation is structured in the near term.”

Due to the correlation with position within the firm, work experience remains a leading factor in carried interest allocations. At the 6 to 9 years of experience range, the percentage of professionals participating in carry increases significantly. After 10 years in the workforce, however, the participation percentage is relatively flat.

On average, bonuses comprised 39 percent of this year’s cash compensation total and contributed more than 70 percent of cash earnings for those taking home more than $1 million.

In most cases, cash compensation increased along with the size of the fund. Those in analyst positions saw the biggest difference in cash compensation between small and large funds. Analysts at big funds, on average, earned nearly double that of their peers in smaller funds. “Although somewhat higher base salaries were in place for the analysts at larger funds, this differential was mostly bonus dependent,” said Kochanek.

About The Report

The 2014 Private Equity Compensation Report is based on an industry survey conducted in October and November 2013. Data was collected directly from hundreds of private equity and venture capital partners and employees. The full report can be purchased at http://www.PrivateEquityCompensation.com

The Report has grown to be the most comprehensive benchmark for private equity and venture capital compensation practices. Some of the participating firms over the years include: Actis, American Capital, Bain Capital, Battery Ventures, BlackRock, Carlyle, Century Capital Management, Cerberus, Comcast Ventures, DuPont Capital Management, EdgeStone Capital Partners, GE, Guggenheim Partners, Highland Capital Partners, Hilco Consumer Capital, Intel Capital, Mission Ventures, Mohr Davidow Ventures, North Atlantic Capital, RBC Capital Partners, RBS, Safeguard Scientifics, SV Life Sciences, Siemens Venture Capital, Venrock, Warburg Pincus, and Wellington Partners.

Jan 6, 2014 | Firms

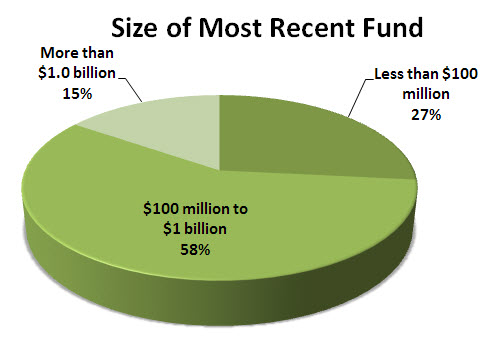

One of the key determining factors in private equity compensation is the size of the fund the professional is working for. Far from a new trend, we have seen this reinforced in numerous surveys dating back several years. However, the differences in compensation practices between funds of varying sizes are more complex than they appear on the surface, and the underlying complexities may be important to those negotiating compensation in the industry.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

However, one complexity is the difference between the size of the firm a professional works for, and the size of the most recent fund offering that firm has launched. We noted less of a differential between firm size than between most recent fund size, which could be a valuable piece of information for job seekers and recruiters alike. So while the gap between large firms and small firms was about $250 thousand in 2012, the gap between those working for a firm that recent launched a large fund and a small fund was only $200 thousand. This 20 percent differential between fund size and firm size may be key to negotiating higher salary when approaching firms that have launched large funds relative to their size.

Of course, compensation depends heavily on title and here we saw discrepancy between fund sizes as well. As a firm grows, not all positions within the firm seem to benefit from the overall higher trend in total compensation. Those at the higher levels of a firm seem to benefit most from the overall growth in compensation. Principals saw the highest differential, well over 100 percent, in total compensation between small firms and large firms. This is likely due to higher incentive pay amongst senior leaders due to the successful growth of the firm. On the other hand, analysts saw very little difference in compensation between small and large firms, earning only about 25 percent more at large funds.

As we can see, while on the surface it seems simple to suggest that those working for large firms earn more than their small shop counterparts, complexities certainly make the comparison more difficult. Differences in recently launched fund sizes and in position within the organization cloud the overall picture. In order to accurately negotiate compensation, such details need to be factored in by human resources professionals and job seekers alike.

May 27, 2013 | Culture

One of the most important factors in retaining top talent in the financial industry is employee satisfaction with their compensation arrangements. Despite this being such a critical leading indicator of potential turnover issues, many firms in the industry do not actively survey their employees on how happy they are with their pay. This can be a critical mistake for firms, especially as the demand for top talent increases as the private equity and venture capital industries grow.

Perhaps not surprisingly, we’ve found that overall pay satisfaction is highly correlated with overall job market conditions within the industry. During times of struggle and declining employment, pay satisfaction tends to increase. However, once the economy heats up and jobs become more numerous, it seems as though employees grow increasingly interested in how much their peers are earning across the street.

2013 Survey Showed an Upward Trend in Satisfaction

That said, despite increased hiring intentions and a relatively robust industry, we’ve seen a markedly upward trend in satisfaction with compensation. According to our 2013 survey, 56 percent of respondents reported they were happy with their pay packages, which is up from 41 percent and 36 percent in the last two years respectively. As the over trends in hiring intentions and employment seem positive, we suspect that the considerable growth in average industry compensation this year is likely a driving factor behind the satisfaction numbers we’ve recorded. However, if our historical understanding of compensation satisfaction holds however, we would expect to see this number begin to decline as hiring intentions begin to shift into real competition for top industry talent.

It is also important to note that satisfaction with pay can fluctuate wildly throughout the year, perhaps with employees feeling underpaid at peak workload periods and adequately compensated during less intense periods. Even a bad day in the office can impact whether someone perceives themselves as being fairly paid.

Overall, the private equity and venture capital industries do reward the hard work of their employees with exceptional compensation. In a broader United States or global employment context, the industry is amongst the most highly compensated in the world. However, that doesn’t mean that some individuals can feel slighted, with much of the dissatisfaction present in the industry is simply competitive tensions and employees wondering if they could make more at another firm. Managing this dissatisfaction is critical to firms that are looking to retain their top talent as competition in the industry heats up.

May 13, 2013 | MBA

There are a number of interesting correlations between education in private equity and venture capital compensation. In our report, we primarily looked at the value that an MBA brings to those in the industry, and whether they experience increased earnings compared to their peers. While we found some interesting trends worth consideration, it’s important to note that this may not tell the whole story when it comes to the value of an MBA in the private equity and venture capital industries.

In 2012 we did note that those with an MBA do on average earn more than their lesser educated peers. In fact, when it came to base salaries, those with the advanced degree earned approximately 12 percent more than peers without the degree. Vacation entitlements, generally three and a half weeks, were largely the same regardless of education level, which likely reflects standardization at most firms.

This doesn’t mean, however, that an MBA is a worthwhile investment for all of those looking to undertake the program in order to get a leg up in the private equity industry. There is a substantial cost to pursuing an MBA. The top tier schools that provide the highest boosts in annual earnings aren’t cheap, and a degree can run an individual over $200,000 when all costs are factored in. When discounting the small advantage in higher salary received by MBAs over their career, serious doubts exist about whether the degree pays for itself.

Further, we found that when it came to bonus payouts, education wasn’t such an advantage. In fact, those with MBAs generally earned a smaller bonus, albeit higher total compensation, than their peers. This relates back to the structure of bonuses being driven primarily by tangible results either individually or as a firm. While an MBA can certainly add value, there is no guarantee that will translate into improvements in any given metric a firm uses to tabulate bonus pay. And as a result of these lower bonuses, the total compensation advantage for those with an MBA was only about 4 percent last year.

That said, some of the value of an MBA can’t be measured in dollars. Those with the degree have vast networks established while in these programs, providing them access to more opportunities than those without time spent in the halls of the elite business schools. For some, this could mean the difference between employment and unemployment during tough times. As a result, there are a large number of individuals that still see a great deal of value in the degree, and we certainly wouldn’t disagree.

In the 2014 Private Equity and Venture Capital Compensation Report, there was a significant decline in the correlation between the number of hours spent in the office, and the total compensation of the employee. While the lowest pay was found among those putting in less than 40 hours per week, perhaps reflecting part-time employees, the highest pay was not found among those working the most hours, over 90 per week. In fact, there was a considerable drop off in compensation for employees working beyond 70 hours a week.

In the 2014 Private Equity and Venture Capital Compensation Report, there was a significant decline in the correlation between the number of hours spent in the office, and the total compensation of the employee. While the lowest pay was found among those putting in less than 40 hours per week, perhaps reflecting part-time employees, the highest pay was not found among those working the most hours, over 90 per week. In fact, there was a considerable drop off in compensation for employees working beyond 70 hours a week.

According to the

According to the  Unfortunately for those managers, the 2014 Private Equity and Venture Capital report found there was a notable decline in pay satisfaction in comparison to last year’s survey. Only 46 percent of employees found themselves satisfied with their pay this year, in comparison to 56 percent of employees in the prior year. This year’s result is still favorable compared to the 41 and 36 percent satisfaction levels noted in the 2012 and 2011 reports respectively, however a shift in the trend will certainly be something that managers will want to keep an eye on in the coming year.

Unfortunately for those managers, the 2014 Private Equity and Venture Capital report found there was a notable decline in pay satisfaction in comparison to last year’s survey. Only 46 percent of employees found themselves satisfied with their pay this year, in comparison to 56 percent of employees in the prior year. This year’s result is still favorable compared to the 41 and 36 percent satisfaction levels noted in the 2012 and 2011 reports respectively, however a shift in the trend will certainly be something that managers will want to keep an eye on in the coming year.

When it came to compensation changes by job title, some positions outperformed others, with Managing Partners, Principals, Directors and Investment Managers seeing some of the biggest increases. In the junior ranks of the firm, analysts, senior analysts, associates and senior associates all saw fairly modest gains.

When it came to compensation changes by job title, some positions outperformed others, with Managing Partners, Principals, Directors and Investment Managers seeing some of the biggest increases. In the junior ranks of the firm, analysts, senior analysts, associates and senior associates all saw fairly modest gains. On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.

On the surface, total compensation is substantially higher among firms managing over a billion in assets. Our survey found that, on average, someone working for such a firm earned about $470 thousand in total compensation (both base and bonus) in 2012. This compared quite favorably to those working at firms managing between $100 million and $1 billion in assets who earned only $267 thousand in total compensation on average. And both large and medium sized firms compared favorably to those working in the smallest of firms, who brought home the least pay earning only $208 thousand in 2012.